The Transmission of Bank Liquidity Shocks: Evidence from House Prices

H Özlem Dursun-de Neef

Review of Finance, Volume 23, Issue 3, May 2019, Pages 629–658, https://doi.org/10.1093/rof/rfy001

The financial crisis of 2007-2009 led to a negative liquidity shock that affected many banks. I study the transmission of this liquidity shock to the real economy by using the heterogeneity in the amount of long-term debt that matured during the crisis. Financing costs increased sharply right after the onset of the crisis. As a result, banks with a larger amount of long-term debt matured during the crisis were affected more heavily. Moreover, banks did not anticipate the coming crisis when they issued the long-term debt before the end of 2006. When the crisis hit, the amount of long-term debt due was an exogenous shock for banks. This makes the amount of long-term debt matured during the crisis a good proxy to measure the individual bank’s exposure to the negative liquidity shock and to study the causal effect of this liquidity shock on banks’ loan supply.

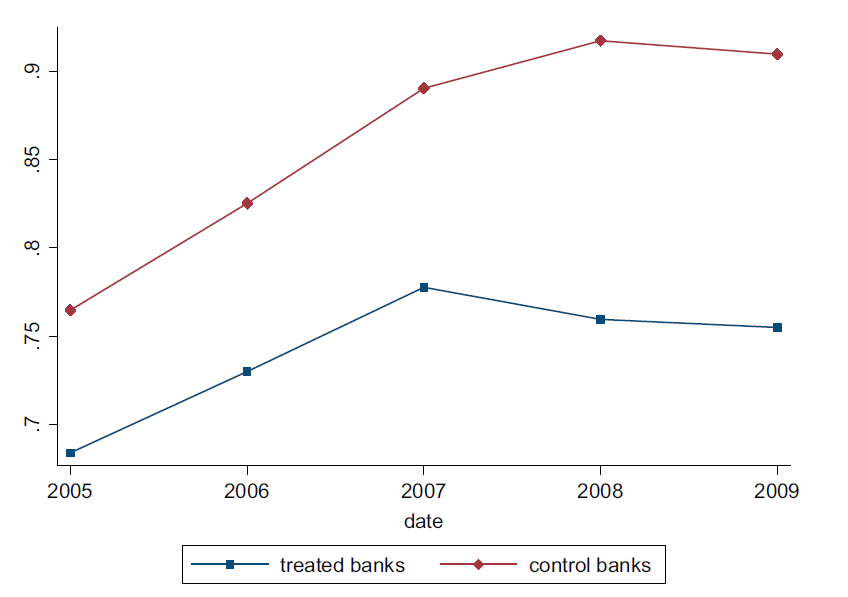

Trends in total loans before and after the crisis. This figure shows the trends in total loans before and after the crisis for treated and control banks. Treated banks are the banks with a positive amount of long-term debt that matured during the crisis. Control banks are defined as unaffected neighboring banks that are located in the same MSAs with treated banks. Total loans is calculated as the amount of total loans divided by 2005 total assets.

My results show that a bank with a 1 percentage point higher long-term debt ratio that matured during the crisis decreased its long-term debt by almost 0.04 percent of its total assets. This suggests that banks had a hard time rolling over their maturing long-term debt. This could be attributed to the sharp increase in financing costs during the crisis. Further, I show that 1 percentage point higher fraction of long-term debt maturing during the crisis led to a significant reduction in a bank’s real estate loans by almost 0.06 percent of its total assets. This result holds particularly strong for under-capitalized banks, banks with lower deposit ratios and banks with higher short-term debt holdings.

I further analyze the transmission of this shock to the real economy through the reduction in the real estate loans by examining house prices in the MSAs where affected banks have branches. My findings show that 1 percentage point increase in the weighted average fraction of long-term debt that matured during the crisis resulted in a 0.13 percentage point decrease in the growth rate of house prices.

Overall, I find that bank lending establishes a transmission channel where negative liquidity shocks are transmitted from banks’ balance sheets to the real economy, and that holding higher bank capital ratios, higher deposit ratios, and lower short-term debt ratios mitigates the transmission through this channel.