Renegotiation Frictions and Financial Distress Resolution: Evidence from CDS Spreads

Murillo Campello; Tomislav Ladika; Rafael Matta

Review of Finance, Volume 23, Issue 3, May 2019, Pages 513–556, https://doi.org/10.1093/rof/rfy021

Financially distressed firms often attempt to renegotiate with creditors outside of bankruptcy court, to forgo the deadweight costs of drawn-out legal battles. However, previous academic research points to numerous frictions that prevent mutually-agreed restructurings, such as transaction costs and asymmetric information. Given the immense amount of claims that end tied up in bankruptcy, it is critical to understand how such frictions affect bankruptcy risk and firm financing. Yet reliable empirical estimates are scarce, because variation in the cost of out-of-court renegotiation relative to bankruptcy is rarely exogenous. Moreover, existing evidence is limited to small samples of firms that complete out-of-court workouts or declare bankruptcy.

Our paper “Renegotiation Frictions and Financial Distress Resolution: Evidence from CDS Spreads” (forthcoming, Review of Finance) provides new, well-identified estimates of the effect of renegotiation frictions on distressed debt resolution and ex-ante debt contracting. We offer two main contributions to the literature. First, our analysis exploits the adoption of a 2012 U.S. law change (IRS Regulation TD9599) that significantly reduced taxes owed by syndicated lenders upon renegotiating debt out of court. Crucially, the ruling did not affect other categories of corporate debt. Additionally, it applied retroactively to loans that were originated years before the regulation’s proposal. These unique regulatory wrinkles allow us to test whether a reduction in tax frictions promoted more distressed debt resolution, by comparing firms with similar distress levels but different amounts of syndicated loans in their pre-existing debt composition.

Our second contribution is to measure renegotiation likelihood using spreads on credit default swaps. CDSs are directly tied to corporate default, as they reflect the amount buyers are willing to pay to insure against bankruptcy. Unlike other measures of default, CDSs trade on a large number of firms and the highly liquid market should react quickly to new information about default risk, such as the announcement of TD9599.

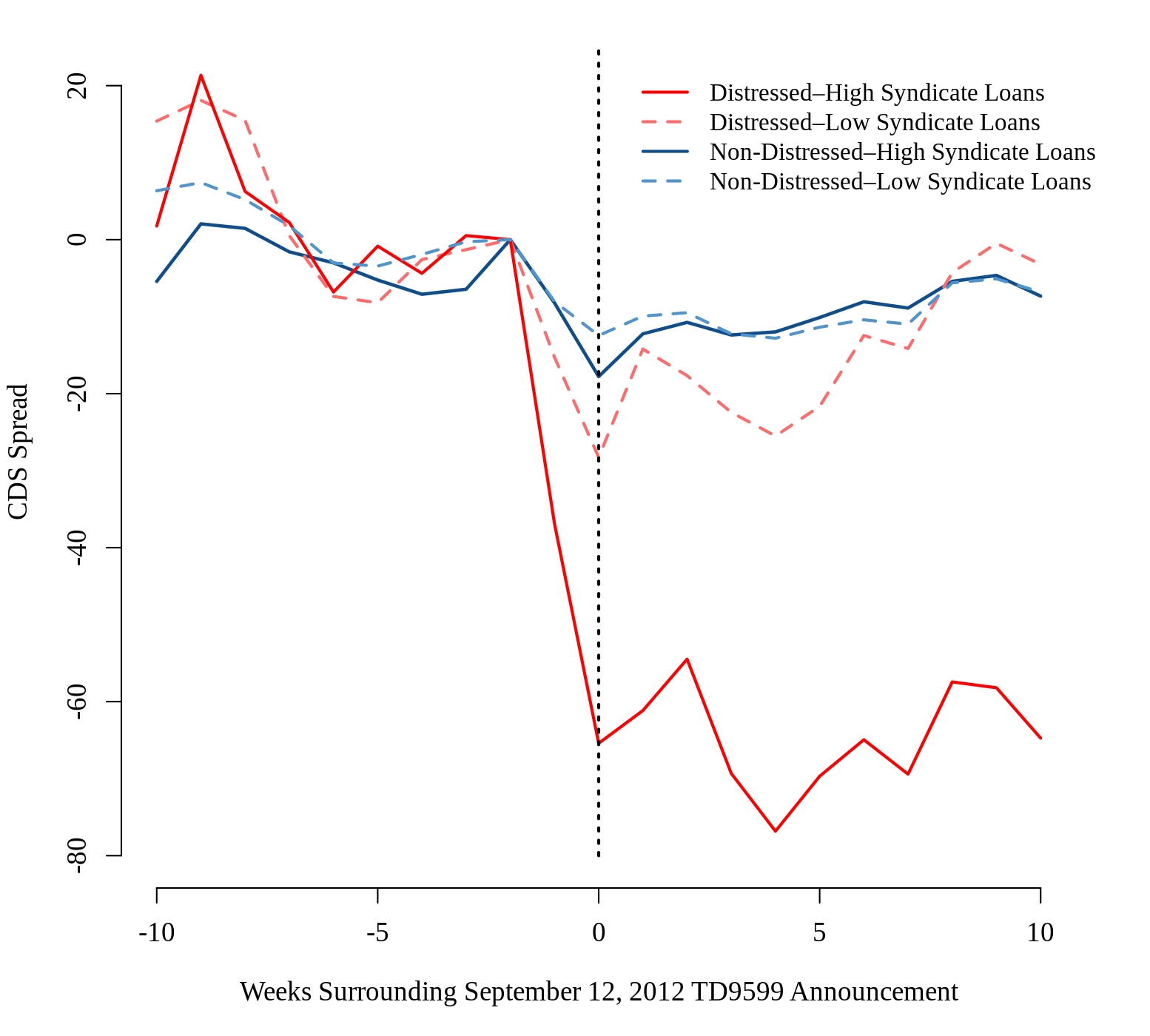

Our analysis compares CDS spread changes across distressed and non-distressed firms, with high versus low ratios of syndicated loans-to-total debt. Figure 1 highlights our main result: When TD9599 was announced, CDS spreads plunged by 65 basis points for distressed firms with high loans-debt ratios, but only fell by 28 points for distressed firms with little syndicated debt. The drop in spreads among non-distressed firms was much smaller and did not vary with the loans-debt ratio. Our estimates indicate that bankruptcy risk fell by nearly 20% for distressed high-loan firms. However, we find no effects for loans issued by banks with low tax rates.

Using a novel dataset, we show that distressed firms’ loan renegotiation rates more than doubled after Regulation TD9599—by far the biggest one-year increase that these firms experienced going back to 2000. We further find that distressed firms’ borrowing costs on new loans fell 10%, and they also gained greater access to the syndicated loan market. This suggests that lenders pass on some of the benefits of efficient debt resolution to borrowers.