Time-Varying Crash Risk Embedded in Index Options: The Role of Stock Market Liquidity

Peter Christoffersen, Bruno Feunou, Yoontae Jeon, Chayawat Ornthanalai

Review of Finance, Volume 25, Issue 4, July 2021, Pages 1261–1298, https://doi.org/10.1093/rof/rfaa040

Market crashes refer to large, unexpected drops in asset prices. They can occur in the presence of news about fundamentals, as well in their absence. In the latter case, theories suggest that market illiquidity is often the culprit. In this paper, we ask: Can information derived from a market liquidity measure help estimate the dynamic of volatility and crash risk of the aggregate stock market? We find that it does. In fact, daily changes in option-implied crash risk is more closely related to daily changes in market liquidity than the market index’s spot variance—a commonly used measure of market uncertainty. We measure stock market illiquidity using the average cost of a round-trip trade for stocks that constitute the S&P 500 index which are estimated from high-frequency trades (Goyenko, Holden, and Trzcinka; Journal of Financial Economics, 2009).

We provide nonparametric and parametric evidence to support our main conclusion. First, we apply a predictive regression analysis showing that an increase in market illiquidity is associated with a more negative skewness estimated non-parametrically from index option prices as well as from intraday index returns. Subsequently, we corroborate our conclusion by estimating a continuous-time model with dynamic crash probability and showing that much of the variation in time-varying crash risk embedded in index options is related to the stock market illiquidity.

Our results raise an important question regarding the economic channels that explain the empirical relationship between market illiquidity and time-varying stock market crash risk. We examine various economic channels and find that the availability of arbitrage capital and adverse selection facing liquidity providers are likely the explanations.

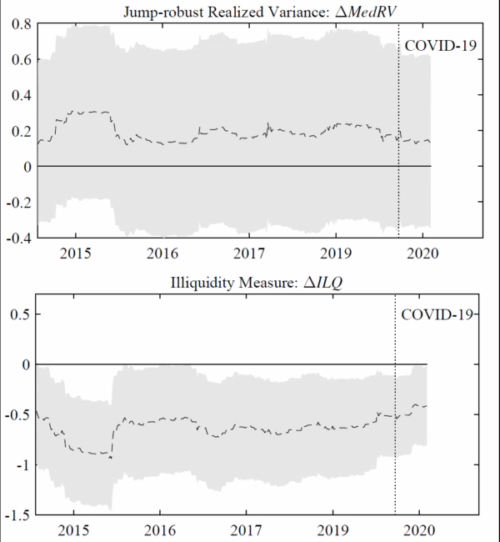

We also extend our sample to include the COVID-19 pandemic period and show that the relationship between option-implied crash risk and market illiquidity remains robust. The Figure included here shows regression coefficients from rolling-window time-series regressions over an extended period. Daily change in option-implied skewness is the dependent variable. As shown in the bottom panel, we find that an increase in market illiquidity is associated with a more negative option-implied risk-neutral skewness. This relationship is statistically significant and is robust to alternative liquidity measures. On the other hand, the top panel shows that the relationship between daily changes in market’s spot realized variance (MedRV) and option-implied skewness is weak.

Existing studies that recovered the probability of tail risk using index options have advocated that the stock market crash risk is time-varying. While several studies in this stream of literature agree that crash risk is time varying, they are less explicit on the economic variables driving its dynamic. We believe that our paper contributes by shedding lights on an important economic variable (i.e., stock market illiquidity) that can be used to facilitate the identification of models with latent jump intensity dynamic.

Figure 1