“Sorry, We’re Closed” Bank Branch Closures, Loan Pricing, and Information Asymmetries

Diana Bonfim, Gil Nogueira, Steven Ongena

Review of Finance, Volume 25, Issue 4, July 2021, Pages 1211–1259, https://doi.org/10.1093/rof/rfaa036

Bank branch closures are a recurring concern for policy makers and researchers alike. The existing literature shows that reduced competition deteriorates loan conditions and local economic development. However, if markets remain competitive after branch closures, and firms have access to other close-by banks, can the loss of soft information caused by branch closures negatively affect loan conditions?

To answer this question, we study new credit relationships of firms affected by the closure of a branch of one of their credit-granting banks. We use Portugal as a laboratory for various reasons. The country has a developed financial system. Most firms are heavily reliant on banks and are not traded, meaning that credit registries and financial statements are often the only sources of hard information on these firms. Portuguese banks were subject to involuntary branch closures in 2012. But the country had still one of the highest branch densities in the world in 2018, which allows us to focus on disruptions in firm-bank relationships and not on branch competition. Finally, Portugal provides rich data on branch closures, financial statements, credit exposures and loan originations for research purposes.

We use coarsened exact matching to compare loans affected by branch closures with similar loans given by similar banks. We show that firms do not get an interest rate discount immediately after branch closures but do get an average discount of 63 basis points when switching banks in normal times. Loans after branch closures have also lower default rates. We only observe the differential effect on interest rates in the first new credit relationships after branch closures. We see no effect for loans given later or when granted by non-local branches of the incumbent banks. These results are consistent with theories of informational holdup in credit markets. Branch closures devalue locally stocked private information and force firms to accept loans from new banks at relatively higher interest rates.

The literature suggests two alternative channels to explain interest rate discounts given to firms that switch banks. Firms might be compensated for shoe-leather switching costs, or discounts might reflect credit market competition. We argue that these alternative channels do not drive our results. First, we match loans these loans with loans given to the same firm by the incumbent bank. Second, we repeat the analysis in areas where branch closures had only a marginal effect on the intensity of competition. Results are similar in both cases.

We address additional factors that may affect the interpretation of our results. For example, branch closures may cause selection at the firm level because they are exogenous. Firms that switch to a new bank after branch closure might be different from firms that switch before branch closure. We provide a battery of robustness tests to assuage such concerns.

Taken together, our analyses provide support for the seminal theories of information holdup that explain the lack of discounts for firms that switch to new banks after branch closures and the presence of discounts for regular switching loans.

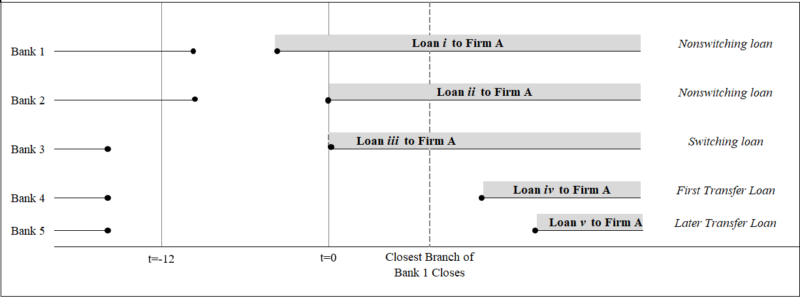

Figure 1: Switching loans, transfers, inside banks and outside banks

The figure above represents the relationships between firm A and five different banks. Before t=0 firm A has a loan outstanding with Banks 1 and 2, the inside banks. At t=0 firm A establishes a relationship with Bank 3. Bank 3 is an outside bank because the firm did not have a relationship with Bank 3 in the previous 12 months. Loans i and ii are nonswitching loans because these loans are granted by the inside banks. Loan iii is a switching loan because it is a new loan granted by an outside bank. Loan iv given by Bank 4 is a transfer loan because the loan is a switching loan and it was given after the branch of an inside bank (say Bank 1) was closed. Loan 4 is also a first transfer loan. A subsequent switching loan v obtained by Firm A from yet another Bank 5 is called a later transfer loan.