The Impact of Financial Advice on Trade Performance and Behavioral Biases

Daniel Hoechle, Stefan Ruenzi, Nic Schaub, Markus Schmid

Review of Finance, Volume 21, Issue 2, March 2017, Pages 871–910, https://doi.org/10.1093/rof/rfw032

A large fraction of households relies on financial advice when making investment decisions. However, existing research presents mixed results on the value of financial advice for clients.

In “The Impact of Financial Advice on Trade Performance and Behavioral Biases”, Daniel Hoechle, Stefan Ruenzi, Nic Schaub, and Markus Schmid argue that one reason for the mixed findings is data limitations existing studies suffer from, which they are able to overcome. Using unique data from a large Swiss retail bank, they document that advisors hurt stock trading performance. However, they help to reduce some of the behavioral biases retail investors are subject to, but this does not overcompensate the negative performance effects of the bad stock recommendations.

The unique feature of the authors’ data is that they include information on when clients and advisors interact with each other and whether the contact was initiated by the client or by the advisor. This feature of the data allows the authors to classify each stock trade as either carried out by the client independently or as being advised. Thus, the authors can compare the performance and the extent to which clients are subject to behavioral biases across advised and independent trades in a within-person setting.

Earlier studies on the impact of financial advice do not investigate the value of financial advice on the trade level but focus on overall portfolio performance. Thereby, they do not differentiate between clients who exclusively trade on advice and clients who only consult their advisors occasionally but also place orders independently, with the latter typically being the much more frequent case. Portfolios of both types of clients are classified as advised in earlier work. This introduces a severe endogeneity problem: For example, investors with poor investment skills might be more likely to rely on advice. Focusing on the overall portfolio performance of these clients could be misleading as inferior portfolio performance could be driven by the poor performance of the trades conducted by these clients independently, even if the advice they received was good.

In addition, as previous studies concentrate on overall portfolio performance they are not able to separate the informational value of advisors’ stock trading recommendations from advisors’ effect on behavioral biases and eventually performance.

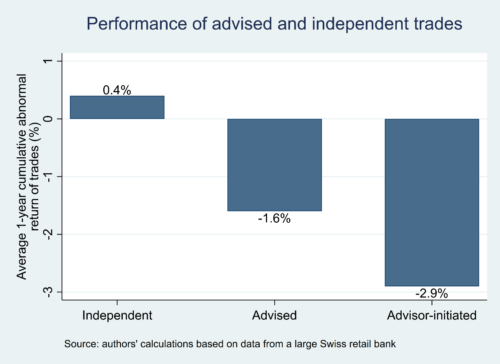

The authors of this study provide new evidence that advised stock trades on average perform significantly worse than common benchmarks and than trades executed independently by the same client. Furthermore, results indicate that advised trades that follow a contact that was initiated by the advisor perform particularly poorly. Advisors’ recommendations seem to follow sell-side analysts and advisors induce clients to trade stocks with lottery-like payoffs, providing an explanation for why advised trades underperform.

The authors then document that advisors help clients to better diversify their portfolios, reduce the local bias (but not the home bias), and encourage clients to realize their losses thereby alleviating the disposition effect. However, overall, the negative stock-picking abilities of advisors are not offset by a reduction of the negative impact of behavioral biases on performance.