Hidden Costs of Hidden Debt

Johan Almenberg, Artashes Karapetyan

Review of Finance, Volume 18, Issue 6, October 2014, Pages 2247–2281, https://doi.org/10.1093/rof/rft053

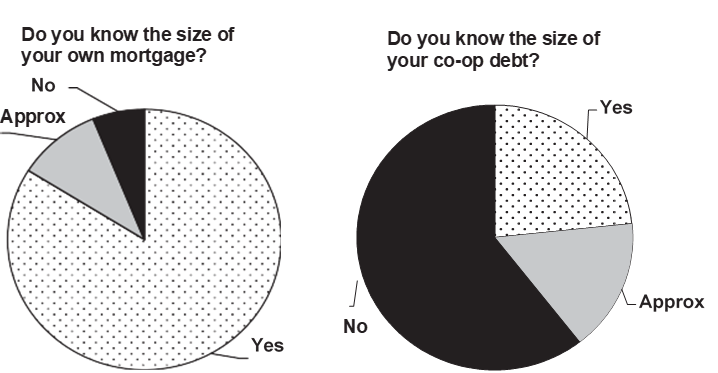

Results from authors’ survey on apartment owners’ knowledge about co-op and personal loans in Stockholm. Total apartment price = co-op debt+personal mortgage (+equity downpayment).

Consumers can make irrational decisions, may be inattentive to key information, and optimize imperfectly. Poor financial decisions are widespread in mortgage and other credit markets, such as credit cards. In the case of mortgage markets the costs of suboptimal decisions may be rather substantial.

In Hidden Costs of Hidden Debt the authors study household decisions regarding a large financial transaction: making a debt-financed acquisition of a home. The setting they examine is the Swedish housing market, in which practically all apartments are organized as housing co-operatives (co-ops) that have their own balance sheets. Co-ops can, and frequently do, take on debt, at the time of development or later. The debt is serviced by the apartment owners. Hence, at time of sale, a buyer of a co-op unit in practice assumes their pro-rata share of the co-op debt. Thus, a household pays a total price that should reflect the sum of the co-op debt and the transaction price. The transaction price is financed by a personal loan and a share of (often small) equity downpayment. As a result, a household acquiring an apartment evaluates different combinations of personal loans and co-op loans.

Co-op loans and personal mortgages are similar in many aspects. Absent any frictions the total price of the apartment should be independent of the share of co-op loan (or, due to a lower net cost of servicing personal loan, total price should decrease with higher co-op loan). By contrast, we find that a 100 USD increase in co-op loans would be reflected in only 30 USD decrease in transaction price on average, increasing the total price by 70 USD. We argue that the underlying reason is a key difference between the two loans: co-op loans are less salient, in the sense that they are less visible and easier for the consumer to ignore. Several factors contribute to making co-op loans less salient. First, when an apartment is for sale, the share of the co-op loan that the buyer would be servicing is not specified in the ad. Second, the monthly fees paid by homeowners include loan instalments, interest payments and maintenance expenses in one total that are not itemized, and only the aggregate debt of the co-op is stated in annual co-op reports.

Following a tax reform implemented at the beginning of 2007, co-op loans became less attractive than personal loans, implying that the marginal rate of substitution should change. We use this natural experiment to evaluate price sensitivity to mortgage debt. We find that the response to the tax change is consistent with our hypothesis that many market participants were pricing co-op debt well below par in the first place.