The Active World of Passive Investing

David Easley, David Michayluk, Maureen O’Hara and Talis J. Putninš

Review of Finance, Volume 25, Issue 5, September 2021, Pages 1433–1471, https://doi.org/10.1093/rof/rfab021

Worldwide, there are approximately 43,192 publicly listed stocks but around 3.3 million indexes, many of which are related to exchange-traded funds (ETFs). This staggering disparity reflects the new reality of investing—for many investors the building blocks of their portfolios are index vehicles, not individual stocks. Specialized, industry and characteristic-based ETFs provide exposure to everything from artificial intelligence (ROBO), to obesity-related investments (SLIM), products favored by millennials (GENY and MILN), meme stocks (BUZZ), factor investing and smart beta strategies. ETFs are blurring the traditional dichotomy between passive and active investing by creating a middle ground of investment vehicles with both passive and active features. We investigate this new reality of “passive” investing via ETFs.

But what exactly does activeness mean in the ETF context? We propose a paradigm based on form and function. While some ETFs are active in form meaning that the portfolio of assets tracked by the ETF is chosen with the objective of generating alpha, other ETFs are active in function meaning that they are used by investors as building blocks of active portfolios. Their ability to be easily and cheaply traded is what sets ETFs apart from index mutual funds and enables activeness in function. We propose new empirical metrics to capture these forms of ETF activeness.

We show that most US equity ETFs are fairly active, this activity level is increasing over time, and more active ETFs are gaining market share at the expense of less active ETFs. Broad, passive ETFs tend to be larger, less numerous, charge lower fees, and trade less actively on secondary markets than ETFs that are active in form or in function. Active-in-form ETFs charge higher fees and have higher levels of portfolio turnover within the fund than active-in-function ETFs, consistent with active management on the part of the ETF issuer. In contrast, active-in-function ETFs are larger, lower cost and have higher turnover in secondary markets, consistent with active investing on the part of investors that use these ETFs as building blocks. Therefore, even ETFs in which the holdings are passively linked to an underlying index can contribute to price discovery through the active trading by investors.

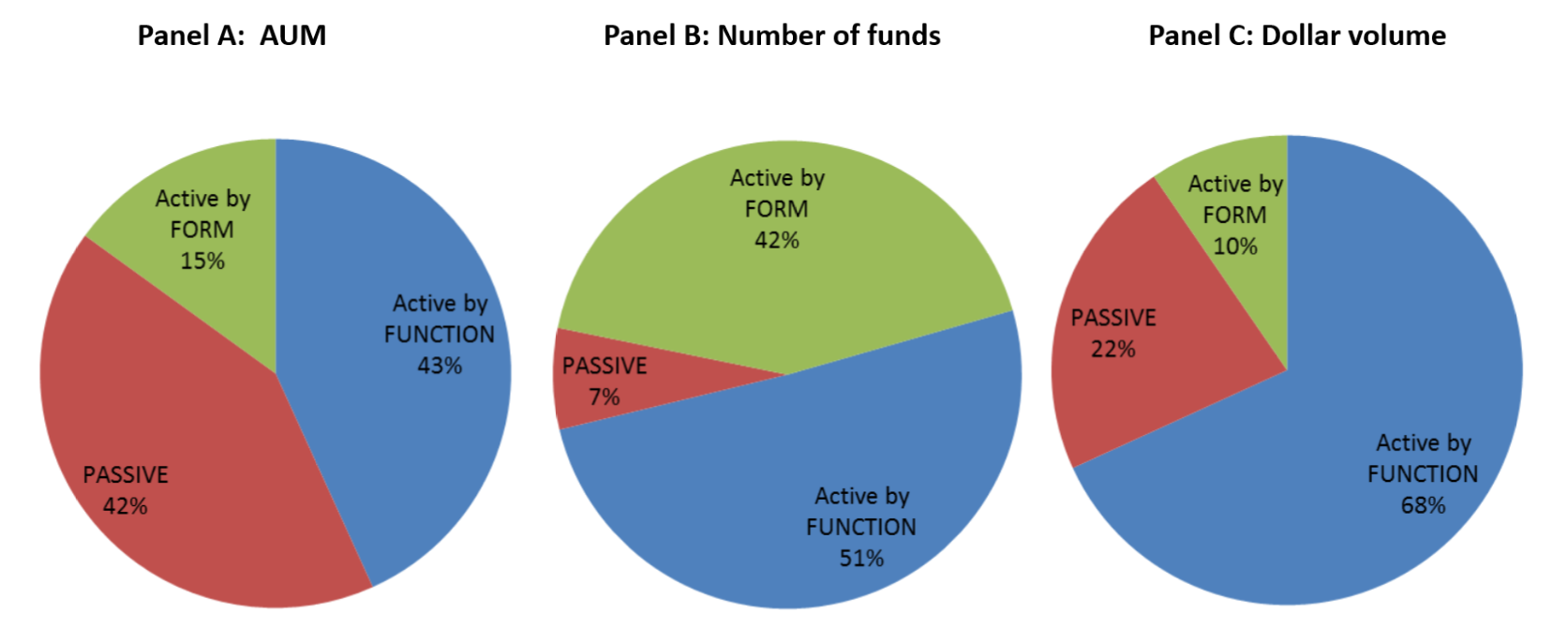

The figure below shows how the cross-section of ETFs is now increasingly characterized by highly active investment vehicles. Active-in-form and active-in-function ETFs account for approximately 58% of the ETF market by assets, 93% by number, and 78% by dollar volume traded in the secondary market. This movement into more active ETFs contrasts sharply with outflows from active mutual funds.

This rise of ETF activeness is relevant for the current debate about whether ETF “free ride” on the price discovery produced by active mutual funds and undermine the efficiency of the market? We argue that the growth in ETFs, by filling the void in the spectrum between active and passive products, need not change the equilibrium level of activeness in the market. Our findings on the increasingly active role of ETFs may assuage concerns about ETFs harming price discovery.

Figure: Breakdown of ETF assets under management, fund count, and secondary market dollar volume by types of activeness and passiveness.