How Much Does Size Erode Mutual Fund Performance

Jonathan Reuter, Eric Zitzewitz

Review of Finance, Volume 25, Issue 5, September 2021, Pages 1395–1432, https://doi.org/10.1093/rof/rfab016

The low level of performance persistence among actively managed mutual funds has led many researchers to conclude that high past returns are more likely to reflect luck than skill. Berk and Green (2004) provide an alternative explanation for the lack of performance persistence. In their influential model, managers are skilled but subject to fund-level diseconomies of scale and rational investors chase performance to the point where expected future returns are equalized across funds. In equilibrium, more-skilled managers manage more assets but—because of diseconomies of scale—earn the same expected future return as their less-skilled peers. Whether diseconomies of scale are to blame for the low observed levels of performance persistence is an empirical question with important implications for our understanding of manager skill and the nature of competition between asset managers. The empirical challenge is that, if more-skilled managers manage larger funds, the correlation between fund size and future returns will be biased towards zero.

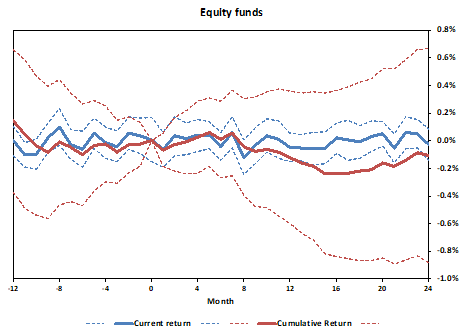

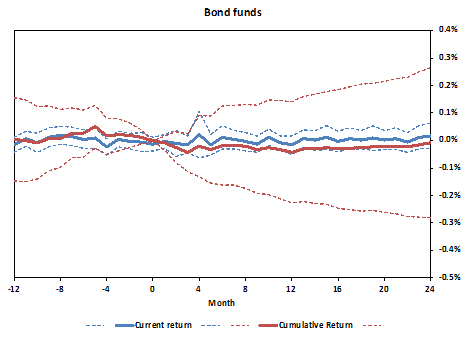

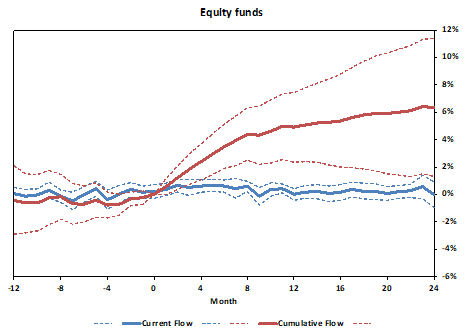

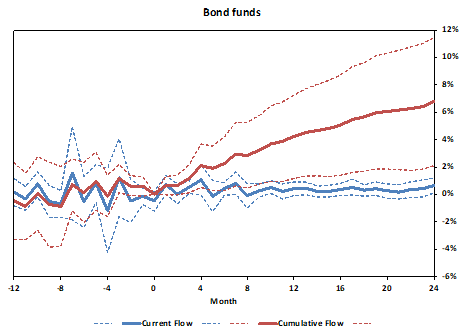

To identify the causal impact of fund size on future returns, we need variation in fund assets that is unrelated to managerial skill. We exploit the fact that small differences in fund returns can cause discrete changes in Morningstar ratings that, in turn, generate discrete differences in fund size. Our empirical strategy relies upon monthly data on the Morningstar Risk-Adjusted Return (MRAR), which Morningstar uses to rank share classes within investment categories for the purpose of awarding star ratings. Using a regression discontinuity approach, we find that ratings significantly increase fund size, but that fund size has a negligible effect on fund returns. For both equity and bond funds, we find that five-star funds receive incremental net flows of approximately 6% over the next 24 months relative to four-star funds, after controlling for MRAR, a large number of control variables, and investment category-by-month fixed effects. Despite these changes in fund size, we fail to detect economically or statistically significant diseconomies of scale within any of the broad or narrow investment categories that we analyze. Our estimates for broad categories of funds (equity, bonds) are precise enough to reject scale diseconomies large enough to meaningfully affect conclusions about performance persistence.

Our findings challenge the view that diseconomies of scale at the fund level are large enough to rationalize the lack of observed performance persistence within broad samples of equity and bond funds. Rather, they are consistent with the traditional view of past returns as at best a noisy measure of skill and with emerging evidence that competition between active managers limits persistence.

Figure I. Current and cumulative net flow discontinuities at 4/5 star boundary. This figure plots the current and cumulative abnormal flows associated with being a 5-star fund relative to a 4-star fund (in month 0). The coefficients come from regressions identical to those in Table III and Table IV, respectively, except for the time period used for the dependent variable. As in Tables III and IV, regressions do not condition on survival; if a fund disappears from the sample in month t+k, subsequent flows and returns are set equal to the category average. The top panel focuses on the sample of equity funds and the bottom panel focuses on the sample of bond funds.

Figure II. Current and cumulative net return discontinuities at 4/5 star boundary. This figure plots the current and cumulative abnormal net returns associated with being a 5-star fund relative to a 4-star fund (in month 0). The coefficients come from regressions identical to those in Table III and Table IV, respectively, except for the time period used for the dependent variable. As in Tables III and IV, regressions do not condition on survival; if a fund disappears from the sample in month t+k, subsequent flows and returns are set equal to the category average. The top panel focuses on the sample of equity funds and the bottom panel focuses on the sample of bond funds.