One Central Bank to Rule them All (Editor’s Choice)

Francesca Brusa, Pavel Savor, Mungo Wilson

Review of Finance, Volume 24, Issue 2, March 2020, Pages 263–304, https://doi.org/10.1093/rof/rfz015

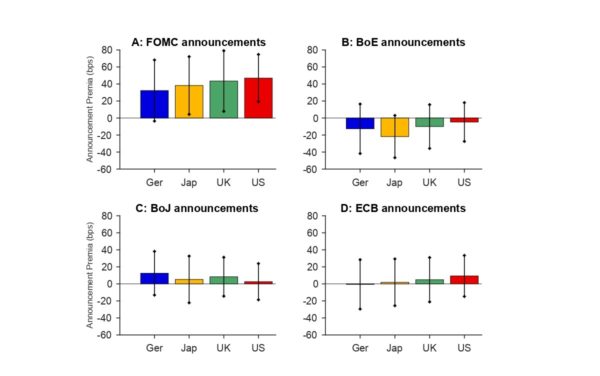

Stock markets across the globe universally enjoy high returns on days surrounding FOMC meetings, which account for the bulk of the global equity risk premia in recent decades. However, there is no comparable result for other central banks either internationally or, more surprisingly, domestically. Similarly, the world CAPM explains the cross-section of returns only during FOMC announcements.

Neither announcement surprises nor currency moves drive these findings, which hold even for stocks whose operations are focused on the domestic economy. The difference in announcement premia is not explained by economy size, multinational exposure to the U.S. economy, or central bank policy activism and toolkit.

We conclude that the Fed exerts a unique impact on global equities. Consistent with this hypothesis, uncertainty drops across global markets following FOMC announcements but not those of other central banks.

Furthermore, the Fed is generally the leader among central banks in setting monetary policy, both in terms of traditional and unconventional policy tools.

Figure 1

This chart reports announcement premia for four major equity markets: Germany (Ger, blue), Japan (Jap, yellow), United Kingdom (UK, green), and the United States (US, red). Announcement premia are defined as the difference between two day average excess returns (in basis points) on announcement and non-announcement days. Announcement days are those trading days when interest rate decisions taken by the Federal Reserve (FOMC, Panel A), the Bank of England (BoE, Panel B), the Bank of Japan (BoJ, Panel C), and the European Central Bank (ECB, Panel D) are scheduled for release. Non-announcement days are those trading days with no announcements by any major central bank. Black dots denote confidence intervals (+/{2 standard deviations). Test assets are Datastream Global Equity indices denominated in U.S. dollars. The sample period is January 1998 (January 1999 for ECB) to December 2016.