“In the Path of the Storm: Does Distress Risk Cause Industrial Firms to Risk-Shift?

Kevin Aretz, Shantanu Banerjee, Oksana Pryshchepa

Review of Finance, Volume 23, Issue 6, October 2019, Pages 1115–1154, https://doi.org/10.1093/rof/rfy028>

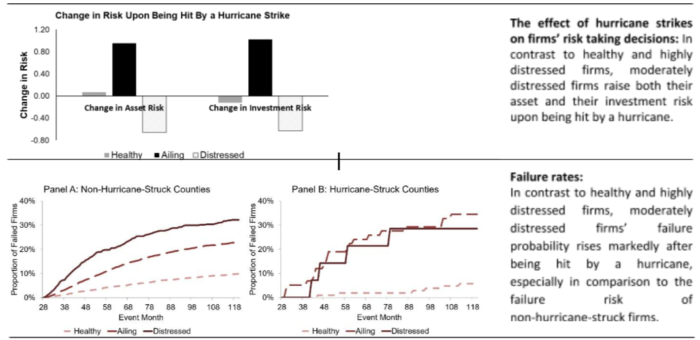

Moderately-distressed industrial firms risk-shift upon being hit by a hurricane strike by investing into high-risk, low-value segments. Creditor control facilitated through covenant violations prevents highly-distressed firms from doing the same.

Theory predicts that, in high financial distress situations, shareholders have incentives to substitute safer assets for riskier assets since they benefit from the upside potential of risky investments at a cost to creditors. In this paper, we offer empirical tests of whether such “risk-shifting” behavior occurs among US industrial firms.

We use two new proxies to capture deliberate managerial decisions about their firm’s operational risk. The proxies are based on the assumptions that a multi-segment firm can be viewed as a portfolio of its operating segments, and that managers deliberately alter the portfolio’s risk through their expansion and contraction decisions. We estimate the risk of that portfolio using Marowitz’s (1952) portfolio variance formula, where the weights are based on either the book values of the segment assets (yielding a proxy for total firm risk) or the capital expenditures of the operating segments (yielding a proxy for the risk of the new real-assets invested into over a year). We calculate the variance–covariance matrix of the different segments using the returns of pure-play firm industry portfolios containing only firms exclusively operating in the segments’ industries.

To study the causal effects of financial distress on a firm’s risk, we use hurricane strikes as exogenous shock to distress risk in a triple differences (“DIDID”) setup. Hurricane strikes fulfil most conditions to be a valid instrument for distress risk, but are able to impact a firm’s risk choices through channels other than the increase in distress risk. To mitigate this confounding effect, we not only contrast hurricane-struck and non-hurricane-struck firms, but also firms with a different financial health before a hurricane strike. Given theory suggests that healthy firms have no incentive to risk-shift, the second contrast should difference out effects other than those arising through the hurricane-induced shock to distress risk.

Our results suggest that moderately distressed firms skew their asset mixes toward higher-risk segments in response to hurricane strikes. In contrast, if anything, more distressed firms skew their asset mixes toward lower-risk segments. Further tests reveal that the risk changes of both types of firms are spurred by the firms restructuring themselves. The moderately distressed firms, for example, tend to change their business orientation and close segments but do not start hoarding (risk-free) cash. We finally offer evidence that the moderately-distressed firms’ actions hurt their creditors – and that they can thus be classified as risk-shifting. Specifically, we show that the firms’ higher risk is the result of poor investments into segments with low growth opportunities (low average-Qs), which raise the firms’ chance to fail over the next ten years. Also, creditor control prevents moderately distressed firms from behaving in the above ways, further suggesting that the risk changes implemented by moderately distressed firms still controlled by shareholders cannot be in creditors’ interests.