Mortgage Debt, Hand-to-Mouth Households, and Monetary Policy Transmission

Sumit Agarwal, Yongheng Deng, Quanlin Gu, Jia He, Wenlan Qian, Yuan Ren

Review of Finance, Volume 26, Issue 3, May 2022, Pages 487–520, https://doi.org/10.1093/rof/rfac011

Many countries have witnessed a tremendous increase in house prices fuelled by mortgage debt accumulation, which in turn imposes a substantial financial burden on households. For example, servicing mortgage debts typically consume as much as 35% of mortgagors’ household disposable income in China. Although rich in housing assets, mortgagors are generally poor in cash and thus exhibit a significant marginal propensity to consume (MPC). The heavy mortgage debt burden is likely to have significant implications for monetary policy transmission when mortgage-servicing costs adjust with the interest rate.

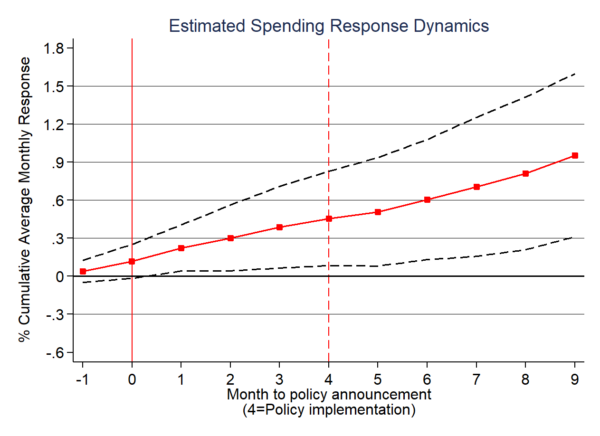

In the paper “Mortgage Debt, Hand-to-Mouth Households, and Monetary Policy Transmission”, Sumit Agarwal, Yongheng Deng, Quanlin Gu, Jia He, Wenlan Qian, Yuan Ren show that the positive disposable income shocks induced by an interest rate cut significantly boosted mortgagors’ consumption. The authors exploit China’s expansionary monetary policy shocks announced in September 2008, which automatically reduced the mortgage rate by 230bps for the population of mortgagors in China starting from January 2009. Using a representative sample of credit card holders from a leading Chinese commercial bank, the authors show that mortgagors increased their monthly credit card spending by 8.7% after the policy announcement, compared with outright homeowners. The credit card delinquency rate also decreased by 1.7% (40bps).

The cash-on-hand constraint is an important mechanism underlying their findings. Constrained mortgagors experienced a more pronounced spending response, and their spending did not increase until the mortgage rate reset. The researchers also confirm that their findings are unexplained by the wealth or intertemporal substitution channel, the contemporaneous fiscal stimulus package, or a more favorable credit expansion to mortgagors after the policy shock.

Collectively, the effect of the debt-service channel is significant—the researchers’ estimate implies an MPC of 0.40-0.54 through credit card spending. With the rise of the middle class, China’s mortgage debt outstanding grew exponentially during the past decade, equivalent to 34% of the GDP by the end of 2020. It implies that the debt-service channel is playing an increasingly important role in transmitting monetary policies in China.

Figure 1: Mortgagors increased their monthly credit card spending by 8.7% after the monetary policy announcement