Cancer and Portfolio Choice: Evidence from Norwegian Register Data

Trond Døskeland, Jens Soerlie Kvaerner

Review of Finance, Volume 26, Issue 2, March 2022, Pages 407–442, https://doi.org/10.1093/rof/rfab022

We examine the effect of a health shock on personal investment decisions. The health shock is a cancer diagnosis. The identifying assumption that allows for a causal interpretation is that the exact timing of the diagnosis is as “good as random”; conditional on being diagnosed with cancer over the next few years. Consequently, we can recover the effect of a cancer diagnosis on investment decisions from the difference in outcomes between households affected today and households affected a few years later.

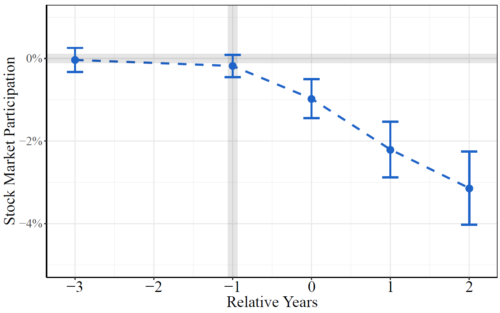

The figure illustrates the first central finding of our paper. The y-axis shows the likelihood that a household participates in the stock market, and the x-axis shows the years around the diagnosis. Averaged across all households and cancer types, a cancer diagnosis reduces the stock market participation rate by about 1.7 percentage points. The parallel trends in the outcomes provide evidence that the results are not driven by trends or realizations of confounders over the event window.

The novelty of the paper is not only that it establishes that adverse health shocks have a causal impact on risk-taking but also the reasons why they do so. Specifically, we investigate the interplay between life expectancy and income in determining financial choices after a change in health status. This analysis starts by comparing the estimated effect of cancer on the likelihood of participating in the stock market with the estimated years lost, which is specific to the cancer type and stage. We find that the probability of exiting the stock market is highly correlated with the expected loss in life expectancy.

Furthermore, in doing a similar exercise for the loss in household income, we find that the higher the income loss, the larger is the effect. Taken together, the two channels, reduction in life expectancy and income loss, account for about 40 to 90 percent of the estimated effects of cancer on personal investment decisions. In a nutshell, our results reveal that certain health shocks, for example, specific cancer types, which lead to revisions in survival expectations and significant drops in income, are the main drivers of the correlation between health status and risk-taking we see in the data.

Figure 1