The term structure of equity yields—a bottom-up approach

David Schröder

Review of Finance, Volume 28, Issue 2, March 2024, Pages 661–697, https://doi.org/10.1093/rof/rfad036

This article proposes a new perspective on the market equity yield curve. Instead of treating the equity market as one single entity, we go one level deeper and consider the equity market as what it really is — a large market of many different individual equity shares. Hence, we start by estimating equity yields of individual shares using the implied cost of capital. Then we aggregate individual equity yields over the entire market to obtain the market equity yield curve.

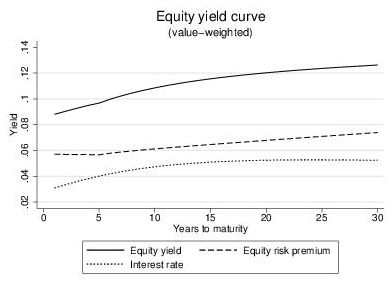

This methodology allows studying the composition effects that drive the market equity yield curve. During the period from 1990 to 2019, the U.S. equity yield curve features a positive aggregation effect, which implies an upward-sloping term structure of equity risk premia. Together with the concave shape of the bond yield curve, the unconditional market equity yield curve was upward-sloping. Yet, there is considerable variation in the equity yield curve over time, depending on the business cycle. We also identify periods with a downward-sloping equity yield curve.

The intuition behind these results is simple. Since companies with higher-than-average risk premia were expected to grow, on average, faster than companies with low risk premia, high equity yield companies were expected to increase in market share when expanding the investment time horizon.

The upward-sloping term structure of equity risk premia is thus the result of the positive association between expected returns and forecasted growth at the firm level. While this empirical finding depends to some extent on model assumptions, various robustness checks show that changing some of these assumptions are unlikely to overturn the results, i.e., generating a significantly downward-sloping average equity yield curve. Under certain conditions, the slope of the term structure of risk premia is negative, but when adding the risk-free rate, the equity yield curve is upward-sloping.