Special Repo Rates and the Cross-Section of Bond Prices: The Role of the Special Collateral Risk Premium

Stefania D’Amico, N Aaron Pancost

Review of Finance, Volume 26, Issue 1, February 2022, Pages 117 – 162, https://doi.org/10.1093/rof/rfab028

Although the market for nominal US Treasury bonds is very large and liquid, previous research has identified a number of cases in which assets with almost identical payoffs carry significantly different prices, including the on-the-run premium, the TIPS-Treasury bond puzzle, and the note-bond spread. We hypothesize that there could be a commonality across these anomalies: a missing risk premium on Treasuries with special collateral (SC) value in the repurchase agreement (repo) market.

To test our hypothesis, we derive a dynamic no-arbitrage term structure model that jointly prices Treasury bonds in the cash and repo markets. We estimate our model using daily prices of all outstanding Treasury securities and corresponding SC repo rates, allowing us to construct a time-varying SC risk premium. The SC risk premium explains about 80% of the on-the-run premium, and a substantial share of other Treasury price anomalies, suggesting that unexpected fluctuations in the specialness spreads of recently-issued nominal Treasury securities are a common risk factor.

We focus on pricing SC risk and provide three main contributions. First, we develop a methodology to account for special spreads at the security level within a dynamic term structure model, which allows us to decompose special spreads of recently-issued Treasuries into expected specialness and SC risk premia. Second, we show that the SC risk premium, and not expected specialness, explains the on-the-run cash premium. Third, we show that the SC risk premium also explains a substantial share of other Treasury price anomalies, confirming that unexpected fluctuations in the SC value of recently-issued securities are a common risk factor. Models that ignore the SC risk premium might interpret a spread between actual and model-implied Treasury prices as anomalous, though most of this spread can be justified as compensation for SC repo risk.

We show that repo special spreads are equivalent to a dividend that is proportional to the asset’s price. Crucially, Treasury market participants price not only the expected repo “dividends,” but also their associated risk. Because our model explicitly accounts for observed SC risk factors, we can identify and estimate SC risk premia separately from other classical risk premia, such as those related to the level, slope, and curvature risk factors.

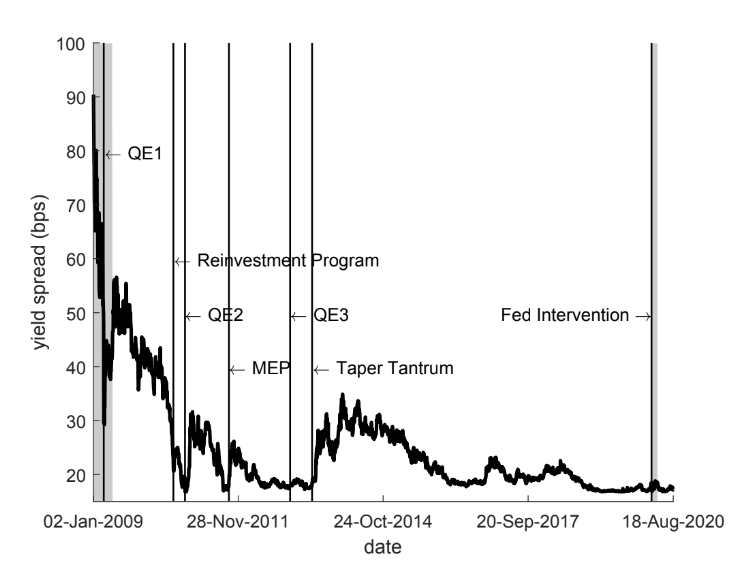

We find that the SC risk premium is large in 2009–2011, especially at the 10-year maturity, as those issues are the “most special” in the repo markets. It fluctuates significantly over time, exhibiting sharp variations following supply shocks, approximated by the FOMC announcements of the Federal Reserve’s asset purchase programs, which reduce the net supply of safe and liquid securities.

At the 10-year maturity, the SC risk premium accounts for about 80% of the on-the-run premium, 64% of the TIPS-Treasury bond puzzle, and 63% of the note-bond spread. This suggests a common underlying economic mechanism across these Treasury price anomalies. These assets command an extra premium due to their exposure to SC risk, which drives a positive wedge between their prices and those of relatively less liquid and safe substitutes.

Figure 1: