Hub-and-Spoke Regulation and Bank Leverage

Yadav Gopalan, Ankit Kalda, Asaf Manela

Review of Finance, Volume 25, Issue 5, September 2021, Pages 1499–1545, https://doi.org/10.1093/rof/rfab019

Regulators often delegate monitoring to local supervisors, which can improve information collection, but can also lead to agency problems and capture. We document that following the closure of a US bank regulator’s field offices, the banks they previously supervised actively increase their risk of failure by distributing cash, increasing leverage, and lending more than similar banks at the same time and place. Supervisor proximity is a channel through which these effects operate. Our findings suggest that local supervision is an important part of regulation, as it facilitates collection of information imperfectly reflected in reported measures, and that switching from onsite to offsite supervision can increase bank risk.

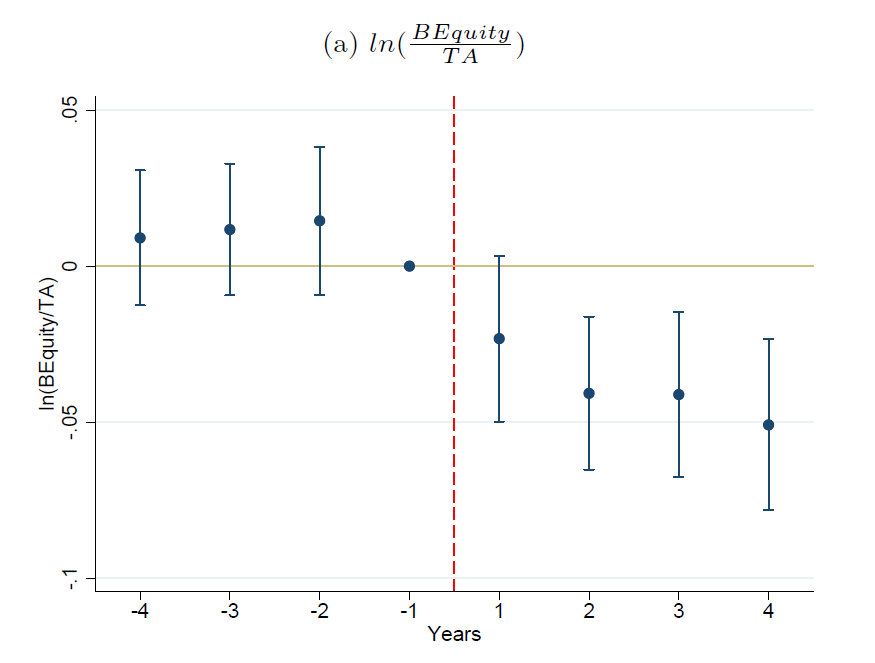

Figure: Effect of Office Closures on Bank Outcomes: Dynamics.

This figure plots the coefficients for the dynamic difference-indifferences regressions that estimate the effect of office closures on outcome variables. Each point on the plot corresponds to the difference in outcome variable for treated banks between the given year and the mean during the year prior to office closures relative to the same difference in control banks. Vertical bars represent 90% confidence intervals based on multi-clustered standard errors at the bank and year-quarter level.