ETF Arbitrage, Non-Fundamental Demand, and Return Predictability

David C Brown, Shaun William Davies, Matthew C Ringgenberg

Review of Finance, Volume 25, Issue 4, July 2021, Pages 937–972, https://doi.org/10.1093/rof/rfaa027

Non-fundamental demand shocks have significant effects on asset prices, but observing these shocks is challenging. In this paper, we show theoretically and empirically that exchange traded funds (ETFs) offer a unique setting to identify and study non-fundamental demand. We develop a model of the ETF market to demonstrate that creation and redemption activities (ETF flows) are symptomatic of shocks that dislocate prices from fundamental values. The intuition is simple: while fundamental value is inherently unobservable, ETFs and their underlying assets share the same fundamental value. Thus, violations of the law of one price between the two signal that at least one of them was affected by non-fundamental demand (e.g., sentiment, noise, etc.).

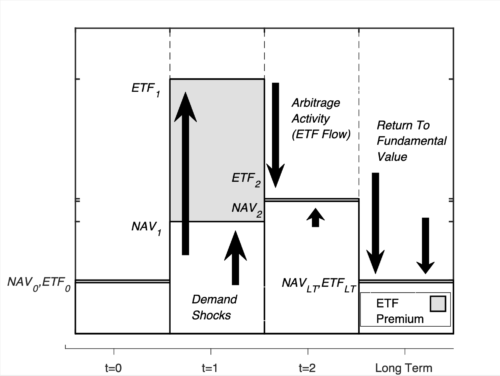

Figure 1 illustrates the mechanism. At t=0, both the ETF and the underlying assets share the same price. At t=1, latent non-fundamental demand shocks arrive and push the price of the ETF above the underlying net asset value (NAV). These demand shocks could differentially affect the ETF and the underlying assets, either because the demand shock that hits the ETF is larger than the shock to the underlying assets or because the ETF is relatively more sensitive to demand shocks. This leads to an ETF premium (i.e., a relative mispricing). At t=2, authorized participants buy shares in the underlying assets and sell shares in the ETF to correct the relative mispricing. They close their trades by creating new shares in the ETF, generating observable ETF flows that reveal the non-fundamental demand shocks. Importantly, while arbitrageurs trade to correct relative mispricing, their trades do not correct fundamental mispricing. Thus, in the long term, the prices of both the ETF and the underlying assets exhibit return predictability as the fundamental mispricing corrects.

We confirm the model’s predictions and show empirically that ETFs provide valuable conditioning information to identify fundamental mispricing. That is, ETF flows predict future asset returns in both an ETF’s shares and its underlying assets, consistent with non-fundamental demand generating mispricings that subsequently reverse. A portfolio which is short high flow ETFs and long low flow ETFs earns excess returns of 1% to 4% per month. Given that most ETFs are passively managed, are traded by a rich cross section of investors and encompass nearly every asset class, our findings show ETF flows provide arguably the cleanest and most extensive measure of non-fundamental demand shocks. Moreover, our analysis allows us to explore the implications of non-fundamental demand; we find it imposes economically significant costs on investors. For example, in State Street’s S&P 500 ETF (SPY), the largest ETF in the world, investors bear additional indirect costs that are an order of magnitude larger than the ETF’s explicit management fee.

Figure 1: ETF Flows as Signals of Non-Fundamental Demand Shocks