Financial Media, Price Discovery, and Merger Arbitrage

Matthias M M Buehlmaier, Josef Zechner

Review of Finance, Volume 25, Issue 4, July 2021, Pages 997–1046, https://doi.org/10.1093/rof/rfaa037

Using merger announcements and applying methods from computational linguistics we find strong evidence that stock prices underreact to information in financial media. A one standard deviation increase in the media-implied probability of merger completion increases the subsequent 12-day return of a long-short merger strategy by 1.2 percentage points. Filtering out the 28% of announced deals with the lowest media-implied completion probability increases the annualized alpha from merger arbitrage by 9.3 percentage points. Our results are particularly pronounced when high-yield spreads are large and on days when only few merger deals are announced.

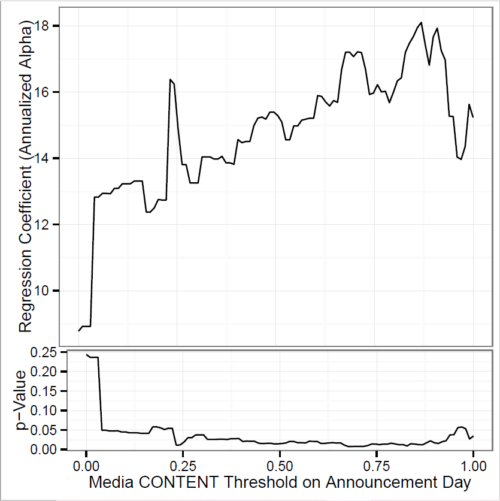

The figure below illustrates a central finding of our paper pertaining to merger arbitrage, an investment strategy that bets on merger completion. The risk-adjusted return (the “alpha”) of a stock portfolio can be increased by excluding those merger deals that have a low media content measure. Specifically, the media content measure represents an estimate of the probability of merger completion, computed based on textual analysis of press articles released around the announcement date of the merger deal. As such, media content possesses predictive power for merger completion or merger failure. It can thus be used as a trading signal to improve the risk-adjusted returns of merger arbitrage.

Figure 1: Media Content Threshold on Announcement Day