A Theory of the Nominal Character of Stock Securities

Bernard Dumas and Marcel Savioz

Review of Finance, Volume 27, Issue 5, September 2023, Pages 1615–1657, https://doi.org/10.1093/rof/rfac071

One would expect that stocks are perfect hedges against inflation because stocks are backed by physical assets. Stocks are claims to payouts that supposedly keep up with inflation. Many empirical studies show that stocks are much less than one-for-one hedges against inflation. Statistically speaking, they have a nominal character. As far as we know, no theoretical explanation has been offered of this surprising empirical finding

We construct recursive solutions for, and study the properties of the dynamic equilibrium of an economy with three types of agents: (i) household/investors who supply labor with a finite elasticity, consume a large variety of goods that are not perfect substitutes and trade government bonds; (ii) firms that produce those varieties of goods, receive productivity shocks and set prices in a Calvo manner; (iii) a government that collects an income-driven fiscal surplus and acts mechanically, buying and selling bonds in accordance with a Taylor policy rule based on expected inflation.

Our explanation is based on the cases in which productivity shocks are the drivers of both stock returns and inflation. Productivity as a third (exogenous) variable moves the two endogenous ones, as in the “proxy” hypothesis of Fama, 1981. The mechanism is fiscal in nature. Since the process for the level of productivity is very persistent, when a positive productivity shock occurs, the future real revenues of the government are increased. Comparing the present discounted real value of the future primary surpluses to the contractually nominal public debt, the positive productivity shock produces a price level that is lower than conditionally expected, i.e. a lower inflation. Meanwhile, the real rate of return on stocks is higher than expected. The nominal rate of return, which compounds the real return with inflation, is approximately as expected: it does not respond to the lower inflation.

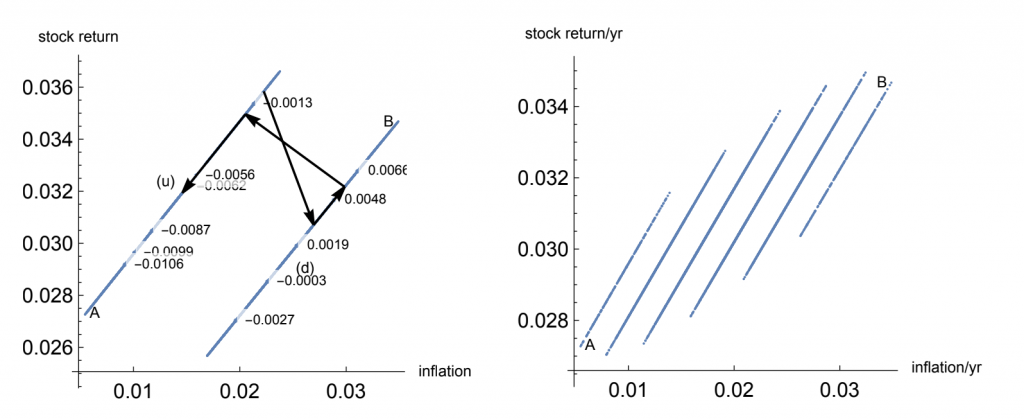

We extend the mechanism to several periods to account for the empirical evidence produced by Boudoukh and Richardson, 1993, who showed that the slope of the relation between nominal stock returns and inflation is higher over a five-year holding period than over a one-year holding period. We simulate our mechanism over many periods. In the plane of inflation vs. nominal stock returns, we obtain a highly organized cloud of points (see Figure): it is organized into rays of positive slope, positioned in such a way that the slope over the entire cloud is exactly as observed by Boudoukh and Richardson.

Introducing money balances only shows that the reasoning can be easily generalized by considering that money balances are also government debt when the government is consolidated with the central bank. One difference is the zero lower bound created by households’ holding of money balances. The simulation results are basically unchanged.

Finally, we consider long-term bonds and find that their rate of return reacts more strongly to inflation than do the rates of return of stocks, in line with what Katz, Lustig and Nielsen, 2017 found in international data.

Figure 1.