Cross-Border Bank Flows and Systemic Risk

G. Andrew Karolyi, John Sedunov and Alvaro G. Taboada

Review of Finance, Volume 27, Issue 5, September 2023, Pages 1563–1614, https://doi.org/10.1093/rof/rfad001

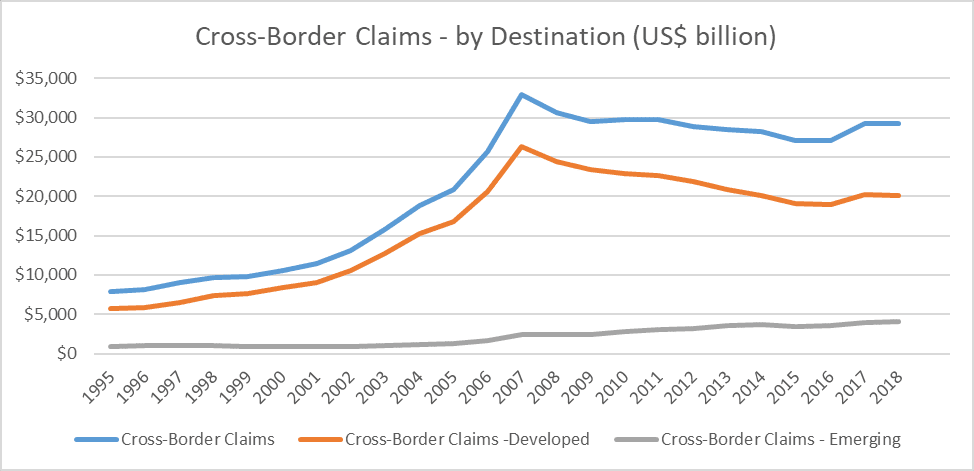

Cross-border bank claims increased from $7.8 trillion in 1995 to a peak of $32.9 trillion in 2007 according to the Bank for International Settlements (BIS, 2009, 2016). Policymakers and scholars asked whether opening up to global influences strengthens or destabilizes a banking system. While the expansion of cross-border bank flows steadied in the aftermath of the Global Financial Crisis (GFC), against the backdrop of the Covid-19 pandemic, global cross-border bank claims surged $2.6 trillion during the first quarter of 2020 (BIS, 2020). There are large cross-country differences in how the expansion and decline of cross-border claims evolved over time. Cross-border claims of BIS-reporting banks on developed countries declined after the financial crisis driven in part by a retrenchment of European banks (IMF, 2015). Yet, as Figure 1 shows, cross-border claims on emerging countries continued to increase after 2008.

The goal of this study is to shed new light on the ongoing debate on whether bank globalization is detrimental or potentially beneficial to the target country’s banking system by assessing the financial stability implications in the target market of heightened bank flows from abroad. Our study uses cross-border claims data from the BIS for 86 countries over the period 1995 to 2018. Our main measure of systemic risk is SRISK? the expected capital shortfall of a bank conditional on a crisis event. Specifically, SRISK measures how much capital a bank would need in a crisis to maintain an 8% capital-to-assets ratio.

We find that cross-border bank flows are reliably associated with significant reductions in aggregate systemic risk in target countries. The reductions in systemic risk are stronger for flows coming from source countries with stronger regulatory oversight than the target country. Such cross-border bank flows linked to regulatory arbitrage are also associated with improvements in target banking sector profitability, asset quality, and efficiency. Other country characteristics do not subsume the importance of differences in regulatory restrictions for the banking systems in understanding the association between flows and systemic risk. Finally, the impact of cross-border bank flows on systemic risk is similar across countries with high and low foreign bank presence. This result is an important finding in that it extends the studies that explore the impact of foreign bank presence on financial stability.

The evidence suggests that the greater presence of source banks from countries with better regulatory quality in the target market by means of these cross-border bank flows serves as a greater monitoring role or one that stimulates better risk management. We also find evidence that target countries benefit from cross-border bank flows, even during times of crises. Our evidence should be of particular interest to regulators concerned with the impact of cross-border lending activities and the transmission of shocks across borders. For researchers, we present what we believe is the first comprehensive evidence of the effect of cross-border flows on the stability of a country’s banking system.

Figure 1. Cross-Border Claims by Year.

The figure shows the total cross-border claims for reporting banks in up to 44 source countries to all target countries from 1995 through 2018. We show the total cross-border claims by target country financial development, based on the BIS classification of countries. Source: Bank for International Settlements Locational Banking Statistics (LBS).