What Constrains Liquidity Provision? Evidence from Institutional Trades

Efe Çötelioglu, Francesco Franzoni, Alberto Plazzi

Review of Finance, Volume 25, Issue 2, March 2021, Pages 485–517, https://doi.org/10.1093/rof/rfaa016

In financial markets, buy-side institutions such as mutual funds and hedge funds play an essential role in providing liquidity to satisfy other investors’ demands for immediate execution of orders. However, some institutions may curtail their liquidity supply during stress periods and pose a threat to market stability.

In the paper, we study institutional liquidity provision and its dependence on funding conditions. We use the Abel Noser (Ancerno) data, which contains transactions covering a vast majority of the U.S. equity mutual funds (397 management companies) and a representative sample of hedge funds (96 management companies) from January 1999 to June 2013.

We first document that institutional liquidity provision forecasts stock-level liquidity. In particular, hedge funds’ liquidity supply is a more powerful predictor compared to that of mutual funds, and such predictive ability strengthens as funding conditions tighten.

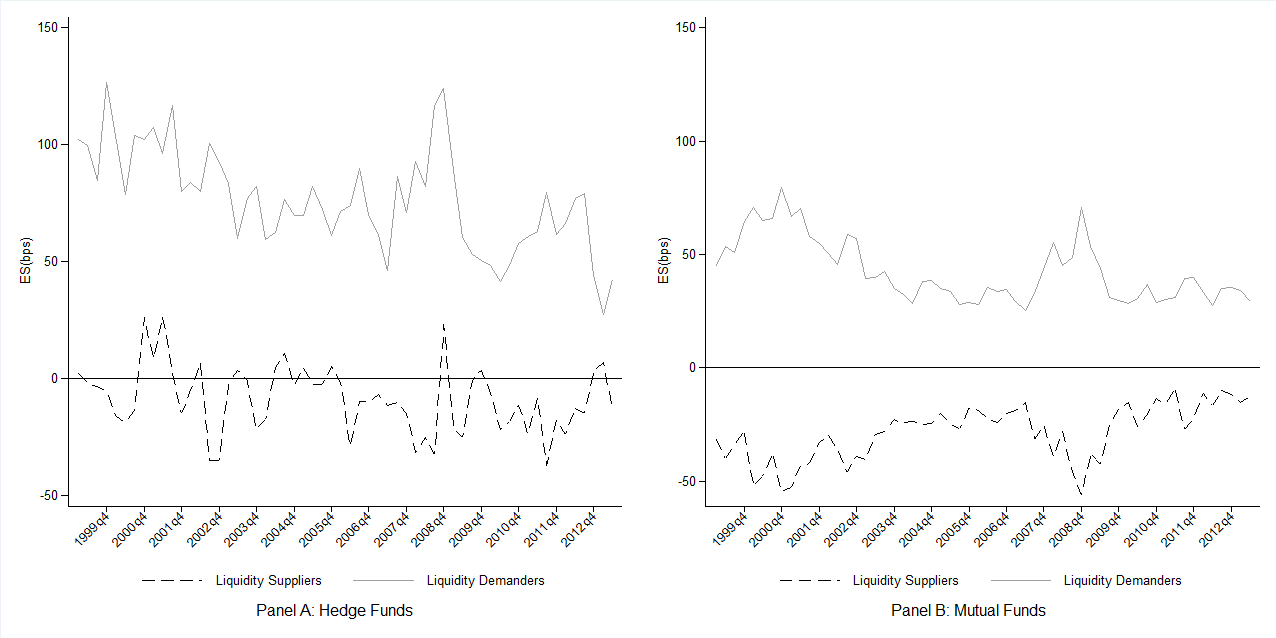

Next, we examine how the extent of institutions’ liquidity provision varies in the time series. Panel A of the figure below shows that during severely stressed markets (early 2000 and the GFC), the price impact of liquidity providing hedge funds rises signi?cantly and moves in the same direction as for liquidity demanders. Besides, the behavior of hedge funds that typically engage in liquidity provisions runs opposite to those of mutual funds, reported in Panel B, which engage more strongly in their activity during periods of scarce capital availability. Regression analysis confirms that this switch towards liquidity consumption is statistically and economically significant. This evidence is suggestive of a constrained behavior, in line with the theory of limits to arbitrage.

To further corroborate our findings, we exploit the cross-sectional dimension of our data and posit that the exposure of liquidity provision to aggregate conditions is likely larger for constrained hedge funds, which we identify as younger funds with high leverage, an illiquid portfolio, and poor recent performance. Indeed, we find that these funds react more strongly to shock in capital availability, which shows that funding constraints have a heterogeneous effect in the cross-section of funds. Furthermore, we document that stocks that were mostly dependent on constrained hedge funds at the inception of the 2007-9 financial crisis exhibit lower resilience, i.e. experience higher trading costs and lower performance, compared to stocks mostly held by unconstrained hedge funds and mutual funds.

Finally, we examine how the behavior translates into trading performance. Financial performance is a key determinant of the stability of funding because margin calls and redemptions respond to portfolio returns. We find that fund-level measures of ?nancial constraints interact with aggregate conditions to generate trading losses in stressed markets, even for institutions that are normally providing liquidity. For these funds, the underperformance persists for at least a month after the initial funding shock, which contributes to explain their withdrawal from liquidity provision.