The Term Structure of Short Selling Costs

Gregory Weitzner

Review of Finance, Volume 27, Issue 6, November 2023, Pages 2125–2161, https://doi.org/10.1093/rof/rfad009

Short sellers not only care about how overvalued an asset is, but when the overvaluation will be corrected. Thus, short selling costs will be higher over horizons when negative information is more likely to arrive. Based on this intuition, I build an infinite horizon model in which short selling costs are determined by both the degree of overvaluation and the likelihood of negative information arriving in each period. The model yields a simple expectations hypothesis in which the long-term rate of any stock loan equals the expected future short-term short selling costs.

To test the model, I construct term shorting contracts using the put-call parity no-arbitrage condition. I use earnings announcements as event studies and find that upward sloping term structures around earnings announcements predict negative earnings surprises as well as negative excess returns, evidence that short selling costs are higher over horizons when negative information is more likely to arrive. I also find that option shorting costs predict future costs and returns, results consistent with the expectations hypothesis of the model.

These results are among the first in the empirical literature to capture the dynamic effects of short sale constraints and provide a new methodology for measuring shorting costs across different horizons. Short selling is rarely completely restricted in financial markets; therefore, understanding how short selling costs are priced across horizon is critical to understanding when information enters asset prices and how long overpricings persist.

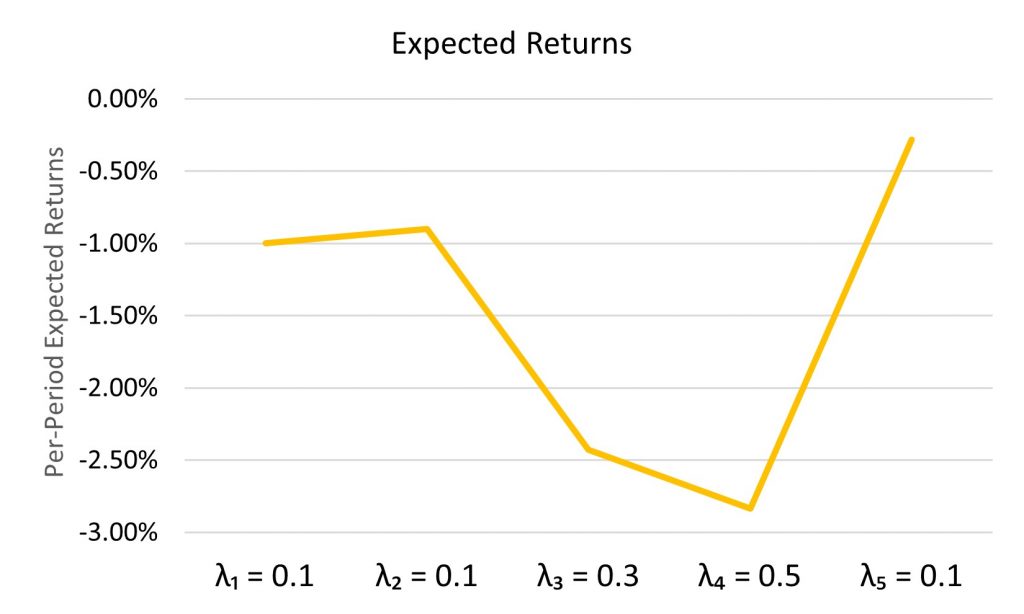

Figure

This figure provides an example of the variation in per-period expected returns of a short sale constrained stock given a stock price normalized to $10 and a true value of $9. The x-axis represents the probability of information arriving conditional on information having not already arrived. Expected returns are exactly equal to the additive inverse of expected lending fees.