The Failure of a Clearinghouse: Empirical Evidence

Vincent Bignon, Guillaume Vuillemey

Review of Finance, Volume 24, Issue 1, February 2020, Pages 99–128, https://doi.org/10.1093/rof/rfy039

Central clearing counterparties (CCPs) are critical institutions in post-crisis financial markets. The role of CCPs is to guarantee derivatives transactions against the failure of counterparties : they are thus supposed to reduce systemic risk and the potential for contagious failures of financial institutions. However, one potential drawback is that CCPs are now becoming extremely large institutions which are connected to all major banks. Therefore, the failure of a CCP itself could be dramatic.

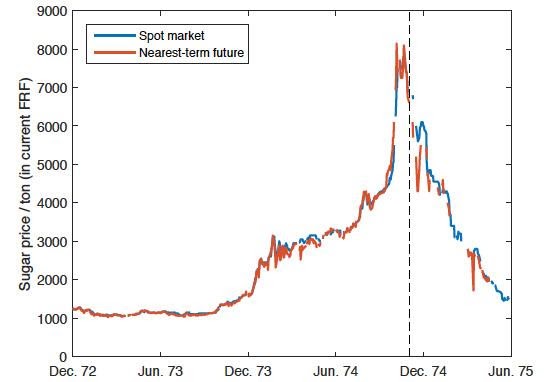

The paper studies the unique event of the failure of a CCP : the failure by the CLAM in Paris in 1974. This CCP was active in the sugar futures market. In 1974, a large increase in global sugar prices, followed by a sharp drop, induced the largest broker in the Paris market to fail. This failure ultimately led the CCP itself to fail. Using novel archive data, the paper analyses the causes of the failure and draws implications for the design and resolution of financial institutions.

While we find evidence of some risk-management failures – in particular the inability to contain the growth of a single large position – our analysis suggests that the main cause of the CCP’s failure arises from agency conflicts. Indeed, evidence strongly suggests that the CCP engaged in risk-shifting in two ways. First, when the large member defaulted on margin calls, the CCP did not immediately liquidate this member’s positions (in violation of its own rules). This can be interpreted as a bet on a price reversal. Later on, when surviving members proposed to buy the entire defaulted position at an attractive price, the CCP refused and instead tried to convince the regulator to shift a larger part of the losses to these surviving members.

This study yields a number of policy conclusions. First, it suggests that agency conflicts can be severe within CCPs. More equity and a member-owned governance structure could usefully mitigate these conflicts. The analysis also highlights the limits of recovery and regulation regimes that give significant discretionary powers to the regulator. Indeed, in the presence of asymmetric information, the defaulted entity may try to misreport relevant information to the regulator to shift losses away from its own equity holders. This lesson is not specific to CCPs and could apply equally well to banks.