Some Borrowers Are More Equal than Others: Bank Funding Shocks and Credit Reallocation

Olivier De Jonghe, Hans Dewachter, Klaas Mulier, Steven Ongena, Glenn Schepens

Review of Finance, Volume 24, Issue 1, February 2020, Pages 1–43, https://doi.org/10.1093/rof/rfy040

This paper studies the strategic lending decisions made by banks after the freeze of the interbank funding market in September 2008. We rely on 160,223 fully documented bank-firm combinations for all banks and firms active in Belgium. We show that banks facing a negative funding shock reallocate credit to sectors where they can more easily extract rents (high market share), to sectors in which they have an information advantage (high specialization), and to low-risk firms.

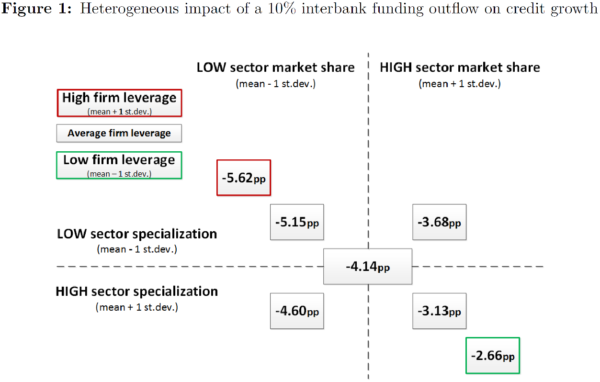

Figure 1 summarizes our main results. It illustrates the lending decisions made by a bank experiencing an interbank funding outflow equal to 10% of its assets. We plot the average impact on credit supply of such a funding shock, together with the effect for each combination of high/low bank sector market share and high/low bank sector specialization, as well as one addition with high/low firm leverage. High (low) is defined as the mean + (-) one standard deviation.

The figure shows that, on average, a 10 percent funding outflow leads to a reduction in credit growth of 4.14 percentage points. Importantly, compared to this average, the impact of the funding shock is 24% larger (smaller) for firms borrowing from banks that have a low (high) market share and low (high) specialization in the firms’ sector (i.e., an effect on credit growth of -5.15 (-3.13) percentage points). Hence, banks direct their attention to sectors where they can more easily extract rents (higher sector market share) or where they have built up superior knowledge (higher sector specialization).

Additionally, the difference becomes even more pronounced when taking into account firm riskiness (proxied by leverage in this example). The impact of the funding shock is more than twice as large for risky firms borrowing from banks that have a low market share and low specialization in the firms’ sector (-5.62 percentage points) compared to safe firms borrowing from banks that have a high market share and high specialization in the firms’ sector (-2.66 percentage points). This suggests that there is a flight-to-quality effect that co-exists with the two aforementioned reallocation effects.

On the real side, we find a moderate reduction in investments for firms borrowing from banks that were hit harder by the funding shock, but the reduction is less pronounced for firms when their bank has a high sector market share.

Our results provide useful information for policy makers that want to ensure access to finance for firms during crisis times, as we show that riskier firms and firms borrowing from banks that have low sector market share and specialization are more vulnerable to shocks in the banking sector. Related to this, firms may prefer matching with banks with a larger sector market share. While this implies a higher cost of borrowing, it also acts as an insurance premium that guarantees access to finance when the bank faces a funding shock. Our findings also contain interesting information for bank regulators, as they reveal a bright sight of lending concentration during crisis times.