More is Less: Publicizing Information and Market Feedback

Andrew Bird, Stephen A Karolyi, Thomas G Ruchti, Phong Truong

Review of Finance, Volume 25, Issue 3, May 2021, Pages 745–775, https://doi.org/10.1093/rof/rfaa028

Financial markets are important to the real economy (Hayek 1945; Baumol 1965). Policymakers generally think that what matters for the real economy is the total amount of information in prices, and so adopt policies that typically take the form of publicizing internal information (e.g., the Sarbanes-Oxley Act of 2002). Internal information is already known to the manager, meaning that real efficiency depends on external information in prices, that which is not known to managers (Bond, Edmans, and Goldstein 2012). We thus ask whether and how publicizing internal information affects the value of financial markets to the real economy.

Publicizing internal information reduces the cost of acquiring internal information for outsiders. We hypothesize that acquisition of external information will be crowded out, reducing the informativeness of the price to the manager, which, in turn, leads to less efficient internal decision making. We test this crowding out hypothesis using the introduction of the EDGAR (Electronic Data Gathering, Analysis, and Retrieval) platform as a quasi-natural experiment. EDGAR makes all SEC filings – corporate disclosures of internal information – immediately and freely available to the public online. Until the early 1990s, investors could only access corporate information through mailed annual and quarterly reports, accessing reports in one of the few public reference rooms in D.C., New York, and Chicago, or following local and national news media coverage.

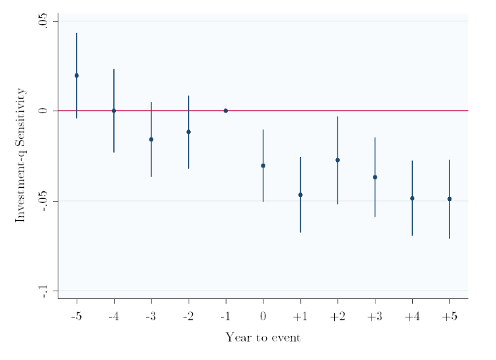

Because sensitivity of investment to Tobin’s q should capture the extent to which the manager learns from the price, this sensitivity should increase in the amount of external information in the price. We use the staggered implementation of EDGAR from 1993–1996 and find that investment-q sensitivity falls by 36.9% after a firm’s filings are available on the EDGAR system, consistent with publicizing internal information crowding out external information gathering, reducing real efficiency. We include firm and industry by year fixed effects to capture firm variation and time trends, and firm controls for performance, capital structure, market capitalization, or age.

Crowding out of external information gathering should be stronger when outsiders’ incentives for gathering information are stronger. In keeping with investors being able to hide their trades after gathering information on more liquid stocks (Kyle 1985), we find that our main result is driven by more liquid stocks. We also hypothesize that our effects should be larger when the manager relies more on external information. We find evidence consistent with this, whether we measure external information reliance using the R2 in a regression of a stock’s returns on market returns or low concentration industries, which one might expect if firm performance is more dependent on market or industry characteristics and trends, respectively.

This figure shows coefficient estimates and 95% confidence intervals for event study regressions estimating the effect of EDGAR on investment-q sensitivity. Treatment happens at t = 0, and the year event t= -1 serves as the benchmark.

Overall, our paper highlights an important and likely unintended consequence of publicizing internal information. Although we study one specific example, many “level the playing field” policies adopted by the SEC and other regulators are similarly based on making internal information more available to outside investors (Levitt 1998). Indeed, given the existence of this information and the scope of requisite regulatory powers, these policies are a natural approach to promoting market efficiency (e.g., reducing information asymmetry). Our findings imply a tradeoff between the potential benefits to market efficiency and reduced real efficiency through the crowding out of external information gathering.