Momentum, Reversals, and Investor Clientele

Andy C W Chui, Avanidhar Subrahmanyam, Sheridan Titman

Review of Finance, Volume 26, Issue 2, March 2022, Pages 217–255, https://doi.org/10.1093/rof/rfac010

A large and growing literature uncovers cross-sectional return predictability based on past price moves. There is extensive evidence for what is known as the momentum effect, which is the tendency of stocks that performed well in the previous six to 12 months to perform well in the next six to 12 months. At shorter intervals, researchers find reversals. Specifically, stocks which outperform over weekly or monthly intervals tend to underperform over similar durations going forward. Understanding why financial markets exhibit such simple forms of predictability is important.

We explore the role of investor clientele in generating momentum and short-term reversals by using the case of different share classes on the same firms as a natural experiment. Domestic retail investors have a greater presence in Chinese A shares, and foreign institutions are relatively more prevalent in B shares. These differences result from currency conversion restrictions and mandated investment quotas.

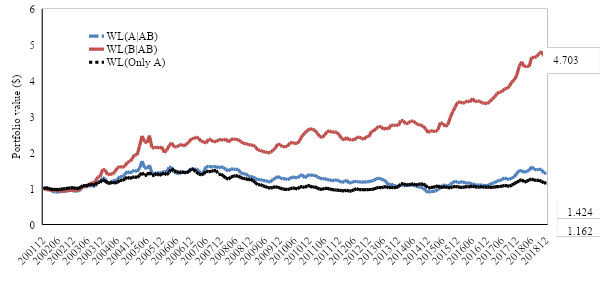

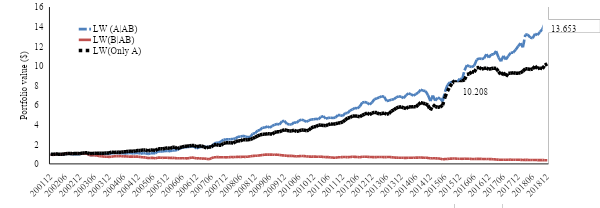

We find that only B shares exhibit momentum and earnings drift, and only A shares exhibit monthly reversals (see Figure). Further, institutional ownership strengthens momentum in B shares. These patterns accord with a setting where short-term reversals (which represent inventory risk premia) prevail in a market dominated by noise traders, and momentum prevails in markets where noise traders are less prevalent relative to informed investors who underreact to fundamental signals. Although we do not rule out the possibility that pricing of cash flow risks (e.g., real options) plays a role in generating momentum, such an explanation is not obvious.

For example, given that the domestic retail investors in A shares are likely more risk averse than foreign institutions and other relatively well-capitalized investors that prevail in B shares, we might expect an explanation based on cash flow risk pricing to generate more momentum in A shares. Instead, we find stronger momentum in the B market, particularly for those stocks held more by institutions. More generally, while stochastic discount factors (SDFs) across A and B markets should be different given market segmentation, what we show is that fluctuations in these SDFs are strongly related to investor clientele. Any neoclassical explanation of these fluctuations would not only need to accord with differing momentum and reversals across A and B shares, but also need to explain other evidence we find such as greater volatility in A shares, the lead from B returns to A returns but not vice versa, and stronger reversals after positive returns. Therefore, explanations of our results based on cash flow risk pricing appear to face daunting challenges.

In sum, our analysis suggests that differences in momentum and short-term reversals across markets are not likely to be due to differences in the fundamental risks of the firms in these markets, but rather due to differences in their investor clientele. Based on this analysis, we conjecture that if investor clienteles become more global, and more similar across markets, that differences in momentum and reversals across the different markets will tend to narrow.

Figure1: Cumulative monthly returns to short-term reversal and momentum strategies

In Panel A, we plot the cumulative returns on three short-horizon return reversal portfolios: (1) A shares in the AB sample, LW(A|AB); (2) B shares in the AB sample, LW(B|AB); and (3) A shares in the Only A sample, LW(Only A). In Panel B, we plot the cumulative returns on three momentum portfolios: (1) A shares in the AB sample, WL(A|AB); (2) B shares in the AB sample, WL(B|AB); and (3) A shares in the Only A sample, WL(Only A). To the right of each plot we show the final dollar values of each of the three portfolios, given a $1 investment.

Panel A: Short-term reversals

Panel B: Momentum