Market Timing and Predictability in FX Markets

Thomas A Maurer, Thuy-Duong Tô, Ngoc-Khanh Tran

Review of Finance, Volume 27, Issue 1, February 2023, Pages 223–246, https://doi.org/10.1093/rof/rfac014

Mean-variance optimized portfolios earn high out-of-sample (OOS) returns in foreign exchange (FX) markets [Baz et al., 2001, Della Corte et al., 2009, Ackermann et al., 2016, Daniel et al., 2017]. We investigate the time-series performance of these portfolios, and show that the conditional Sharpe ratio and crash risks are time-varying and predictable. We can exploit this information, and trade more (less) aggressively when prices of risks are higher (lower). This market timing is valuable and significantly improves the performance compared to strategies that use inferior market timing policies.

All conditionally mean-variance efficient strategies have proportional portfolio weights, and achieve the same conditional Sharpe ratio. However, these strategies generally differ with respect to the asset allocation, i.e., the time-variation in the notional value or leverage. Since the conditional Sharpe ratio varies over time, differences in the time-variation in the notional value implies that these portfolios earn different unconditional Sharpe ratios. We denote this time-variation as market timing.

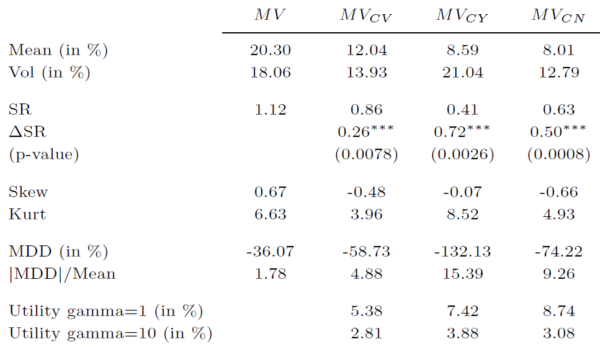

Our main focus is the strategy MV that maximizes ?-??2, where ? and ?2 are the conditional expected excess return and variance of the currency portfolio, and ? is a time-invariant parameter. MV delivers the optimal conditional Sharpe ratio. Moreover, it invests more (less) when market prices of risk in FX markets are high (low). Therefore, MV’s market timing exploits the time-variation in the conditional Sharpe ratio, leading to an attractive unconditional return distribution.

In comparison, MVCN maximizes the conditional Sharpe ratio and rescales the portfolio such that the notional value is constant and equal to one. Thus, there is no market timing by design. Due to the lack of market timing, we expect MVCN to underperform MV. Next, MVCV maximize the conditional expected return subject to a constant target volatility. Thus, the notional value only varies with the conditional return volatility, but not the conditional expected return. We expect that the MV is superior to MVCN due to volatility timing, but inferior to MV as MV also uses information about expected returns for the market timing. Finally, MVCY minimizes the conditional portfolio variance subject to a constant target yield. This implies a low (high) notional value when the conditional expected return is high (low). Accordingly, the strategy invests less (more) aggressive when conditional prices of risk are high (low), which is opposite to MV, and we expect a relatively poor unconditional performance.

We use FX returns from 1983 to 2016 to compare the out-of-sample performance of the four strategies. Confirming our intuition, we find that MV has a significantly higher unconditional Sharpe ratio, higher skewness, and lower maximum draw down than MVCV, MVCY, and MVCN. The superior performance of MV has important implications for asset allocations. Our results suggest that leverage or risk limits are costly when market conditions are time-varying and market timing is highly profitable. In practice, such limits are often imposed on portfolio managers (in addition to less tight regulatory constraints). Thus, it is important to understand the implicit costs associated with such leverage or risk limits.

Figure 1