Intellectual Property Protection and Financial Markets: Patenting versus Secrecy

Nishant Dass, Vikram Nanda, Haemin Dennis Park, Steven Chong Xiao

Review of Finance, Volume 25, Issue 3, May 2021, Pages 669–711, https://doi.org/10.1093/rof/rfaa033

To create value, firms in technology–intensive industries must crucially protect their intellectual property (IP). Some firms protect their IPs by relying on trade secrecy, which keeps other firms from learning about their inventions. Others choose to disclose the details of their inventions by filing for patents, which legally exclude others from using their IPs until the patents expire.

In this paper, we examine how changes in the trade–off between patenting and secrecy affect firms’ stock liquidity and financing outcomes. Stock liquidity is generally considered a desirable feature for public firms, because greater tradability of a stock can generate greater interest from external investors and reduce the cost of raising capital from the stock market (Amihud and Mendelson, 1986; Amihud, 2002; Easley and O’Hara, 2003). One critical element causing stock illiquidity is adverse selection due to the information asymmetry between firm and market participants (Easley and O’Hara, 2003). As a result, greater information disclosure through patenting should reduce the adverse selection component of trading costs and enhance stock liquidity (Balakrishnan et al., 2014). The enhanced stock liquidity in turn will enable a firm to raise equity financing more easily and secure resources for subsequent investment to fuel the firm’s growth.

To identify changes in firms’ choice of IP protection, we utilize a natural experiment in the context of the Trade–Related Aspects of Intellectual Property Rights (TRIPS) Agreement, which came into effect in 1995. TRIPS increased the relative benefits to firms of patenting, compared with secrecy, by instituting minimum levels of IP protection that governments around the world had to grant to firms from their fellow World Trade Organization (WTO) member countries. Using difference–in–differences (DiD) models, we compare firms in industries that are reliant on patents (our treatment group) with those that are not (our control group), before and after the implementation of TRIPS.

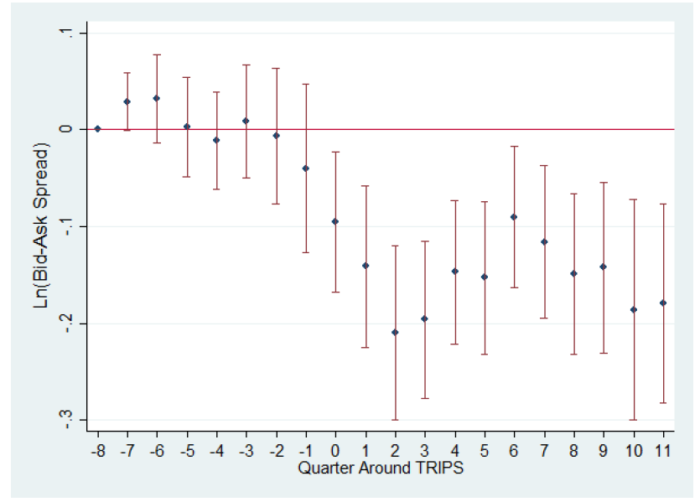

Our analysis shows that the implementation of TRIPS which strengthened patent protection led to a 10.2% increase in the number of patent applications and a 14.0%–27.1% improvement in stock liquidity for firms in patent–reliant industries. This in turn allows the affected firms to increase equity financing by 1.9% and reduce leverage by 5.9%.

Our findings suggest that IP protection policies can play an important role in encouraging firms to patent rather than use secrecy to protect their intellectual property. Patenting reduces information asymmetry and enables firms to issue information–sensitive securities, such as equity. Therefore, policies that promote use of patenting over secrecy can reduce informational frictions in equity markets.

Figure 5: Diference in ln(Bid{Ask Spread) Between the Treated and Control Group Around TRIPS

The figure shows the coefficient estimates of the DiD Model (5) using quarterly ln(Bid-Ask Spread) as the dependent variable. Horizontal axis refers to quarters from two years before to two years after the implementation of TRIPS in 1995. Each node represents the coeffcient estimate on the interaction between Treated and the corresponding time dummy. The cap spike is the 95% confidence interval. Quarter 0 is 1995Q1, when TRIPS became effective. The coefficient on Treated x Quarter(-8) is set as the baseline in the regression.