How Rational and Competitive Is the Market for Mutual Funds?

Markus Leippold, Roger Rueegg

Review of Finance, Volume 24, Issue 2, March 2020, Pages 579–613, https://doi.org/10.1093/rof/rfz011

How rational and competitive is the market for mutual funds? The answer is: very. In their paper, Markus Leippold and Roger Rueegg analyze more than 60,000 equity and fixed income funds across different regions from 1992 to 2016. They compare the value-weighted returns of active managers to the value-weighted portfolios of all index funds within the same investment category.

For most categories, they cannot reject the null hypothesis that net alphas to investors are zero. Indeed, they even find categories such as “US Fixed Income” and “Global Equity Large Cap” for institutional investors with significant alphas from active management before fees. However, US large-cap equity funds seem to be an exception.

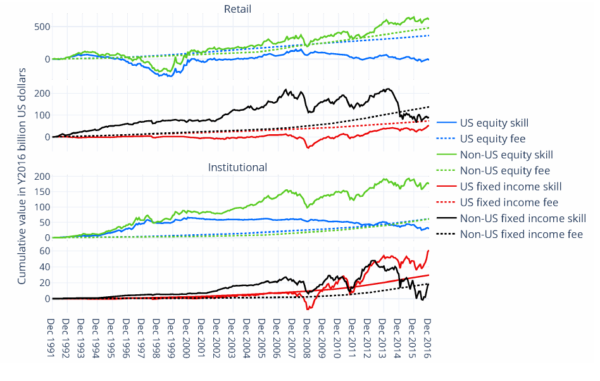

Aggregated skill and fee for US and non-US mutual funds

The figure above shows the aggregated added value from active management (skill) and the aggregated fee for retail and institutional funds. Non-US funds equity funds exhibit higher aggregated skill compared to the earned management fee. For US equity funds, the return of active minus index investors is close to zero and thus below the costs of active management. Their poor performance might be due to excessive overfunding compared to, e.g., the more successful European funds. For the fixed income funds, both US and non-US retail funds deliver returns below the fee charged. For the institutional investor, active fixed income managers delivered returns that made up for the fees charged.

Sorting active fund portfolios according to their performance persistence, fees, and size, they find that low-fee winner portfolios and small winner portfolios tend to outperform, but their alpha does not survive their novel robust test statistics. These results give further support to the competitive equilibrium proposed by Berk and Green (2004). The analysis also highlights some substantial differences between institutional and retail funds. In particular, active retail investors are better advised to avoid high-fee losers and small losers. Their alphas are negative and statistically significant.