Financial Literacy in the Age of Green Investment

Anders Anderson, David T Robinson

Review of Finance, Volume 26, Issue 6, November 2022, Pages 1551–1584, https://doi.org/10.1093/rof/rfab031

Anthropogenic climate change has made sustainable investment a hot topic across the globe. Increasingly, financial market participants place growing importance on sustainability and other ESG considerations. Ultimately, these trends raise questions about the nature of underlying household demand for socially responsible behavior from firms and other financial market participants.

To better understand the impact of ESG preferences on capital market outcomes and firm behavior, a number of recent theoretical papers have taken up the connection between pro-social shareholder preferences and corporate behavior or asset prices. A common feature across models is the assumption that investors express their pro-social preferences through their portfolio choice decisions.

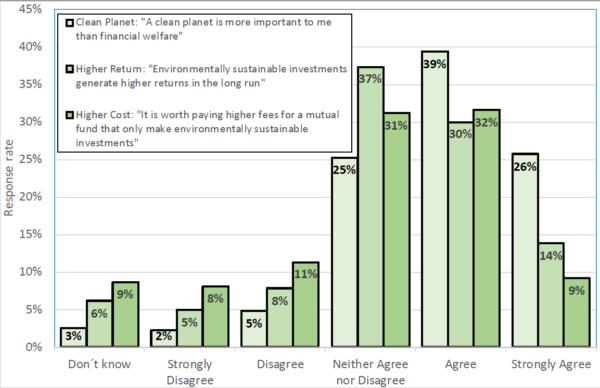

In this paper we empirically test this basic premise. Focusing specifically on environmental considerations (the E in ESG), we ask a simple question: do green households make green financial decisions? To do this we ask Swedish households their views about sustainable investment (see Figure). Then we connect the responses to administrative data that allow us to relate pro-environmental attitudes and values to retirement savings behavior and direct stock holdings.

We find that pro-environment households are not more likely to hold pro-environment portfolios. There are two key factors that drive this result. The first is financial disengagement. Households that exhibit strong pro-environmental behaviors and beliefs are financially disengaged and generally uninterested in financial matters. Individuals who place a high priority on environmental considerations are around 10\% less likely than others to hold stock directly, controlling for demographics. The magnitude of this effect is large compared to other demographic variables. In a mandatory-participation national retirement plan, they are 20% less likely than others to check their retirement balance, and they are less likely to make an active allocation decision, instead relying on the default allocation option.

The second factor is the presence of informational constraints. Making green investment decisions involves added layers of informational complexity; these prevent less financially sophisticated individuals from expressing their green preferences through their portfolio holdings. For example, among those who make an active choice in their retirement portfolios, environmentally oriented investors are more likely to buy mutual funds with pro-environmental names, but they are not more likely to buy funds that are labeled as ESG-compliant in the more complex financial statements that households receive every year.

These same households say they recycle more than their neighbors, and say they are willing to pay more for green products. This environmental engagement simply does not to cross over into the realm of financial engagement. The financial disengagement that we document among the environmentally engaged households is a challenge for the “people’s capitalism” framework that underpins many discussions concerning the market’s ability to capture pro-social preferences.

Figure