Bruce D Grundy, Sjoerd van Bekkum, Patrick Verwijmeren

Review of Finance, Volume 28, Issue 4, July 2024, Pages 1187–1213, https://doi.org/10.1093/rof/rfae006

How does corporate debt issuance depend on sovereign debt issuance? In the US and Europe, corporate and sovereign debt issuance might be seen as substitutes, with sovereign debt issuance crowding out corporate debt issuance. However, many countries do not have the large, deep, and liquid bond markets as seen in the US and Europe. This paper examines the relation between long-term corporate and sovereign debt issuance by exploiting variation across the world, with many countries having extended periods without any long-term sovereign debt issuance.

We focus on potential complementarity instead of substitutability. Without a sovereign benchmark rate, corporations might face a challenge in issuing bonds that potentially substitute for sovereign bonds. Informal talks with practitioners indicate that firms are likely to delay long-term debt issuance until a sovereign debt benchmark exists, and that firms sometimes actively lobby the government to issue a sovereign bond that will provide a default-free benchmark at a particular maturity. Consequently, corporate and sovereign bonds may act as complements. We study this potential complementarity by exploiting worldwide introductions of long-term sovereign bonds and by using granular data on debt issuance in a range of countries.

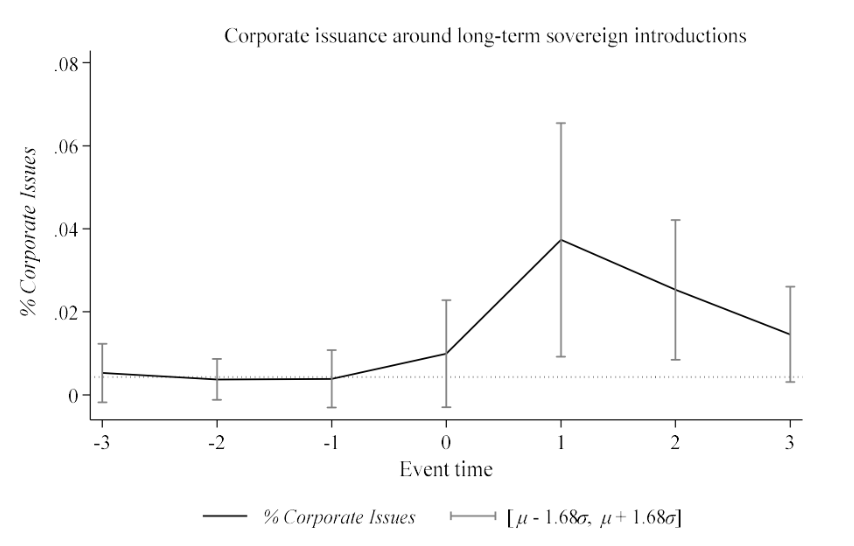

The first part of our analysis focuses on 11 introductions of long-term sovereign bonds that allow us to investigate the timing of changes in the maturities of sovereign and corporate bonds. We find that introductions of sovereign bonds that increase the maximum tenor of government debt are followed by the issuance of corporate debt of the new longer maturity. The corporate response is largest in the year immediately following the sovereign bond introduction. The issuance of corporate bonds of similar maturity to the newly-issued sovereign bond measured as a percentage of total corporate bond issuance increases by around one standard deviation, corresponding to about 8 percentage points.

One appealing explanation for issuance complementarity is that corporate bond issuers can use the yield on a sovereign bond of the same maturity and currency as a benchmark rate. To study the benchmark explanation in detail, we examine 31,474 sovereign bond issues and the history of sovereign yield curves across 14 countries and 27 years. We find that a variety of measures of sovereign availability and issuance are important explanators of corporate issuance. As such, our evidence highlights the role that sovereign debt and its maturity can play as an important facilitator of capital market development.