Asset Prices and Portfolios with Externalities

Steven D. Baker, Burton Hollifield, Emilio Osambela

Review of Finance, Volume 26, Issue 6, November 2022, Pages 1433–1468, https://doi.org/10.1093/rof/rfac065

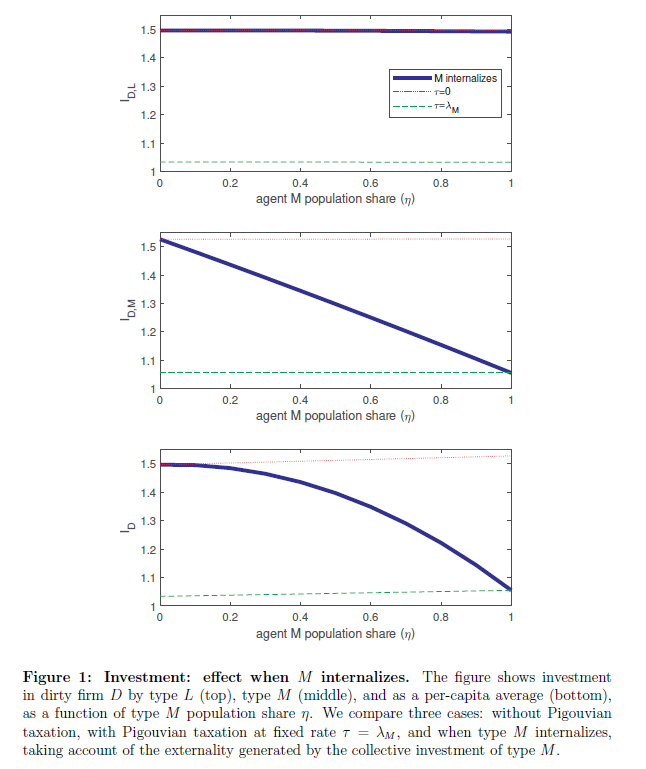

Elementary portfolio theory implies that environmentalists optimally hold more shares of polluting firms than non-environmentalists, and that polluting firms attract more investment capital than otherwise identical non-polluting firms through a hedging channel. Pigouvian taxation can reverse the aggregate investment results, but environmentalists still overweight polluters. We introduce countervailing motives for environmentalists to underweight polluters, comparing the implications when environmentalists coordinate to internalize pollution, or have nonpecuniary disutility from holding polluter stock. With nonpecuniary disutility, introducing a green derivative may dramatically alter who invests most in polluters, but has no impact on aggregate pollution.

Figure 1