A Tale of Two Cities: Mainland Chinese Buyers in the Hong Kong Housing Market

Yi Fan, Maggie Rong Hu, Wayne Xinwei Wan, Zhenping Wang

Review of Finance, Volume 27, Issue 6, November 2023, Pages 2205–2232, https://doi.org/10.1093/rof/rfad006

A burgeoning literature shows that global real estate markets are subject to the “China shock” in recent years. The impact of Chinese investments on local real estate has had rapid ramifications for other socioeconomic aspects, such as neighbourhood quality and local employment. It is thus important to understand whether mainland buyers are truly the driving force for the rising housing prices in destination countries/regions, or just an easy target for blame.

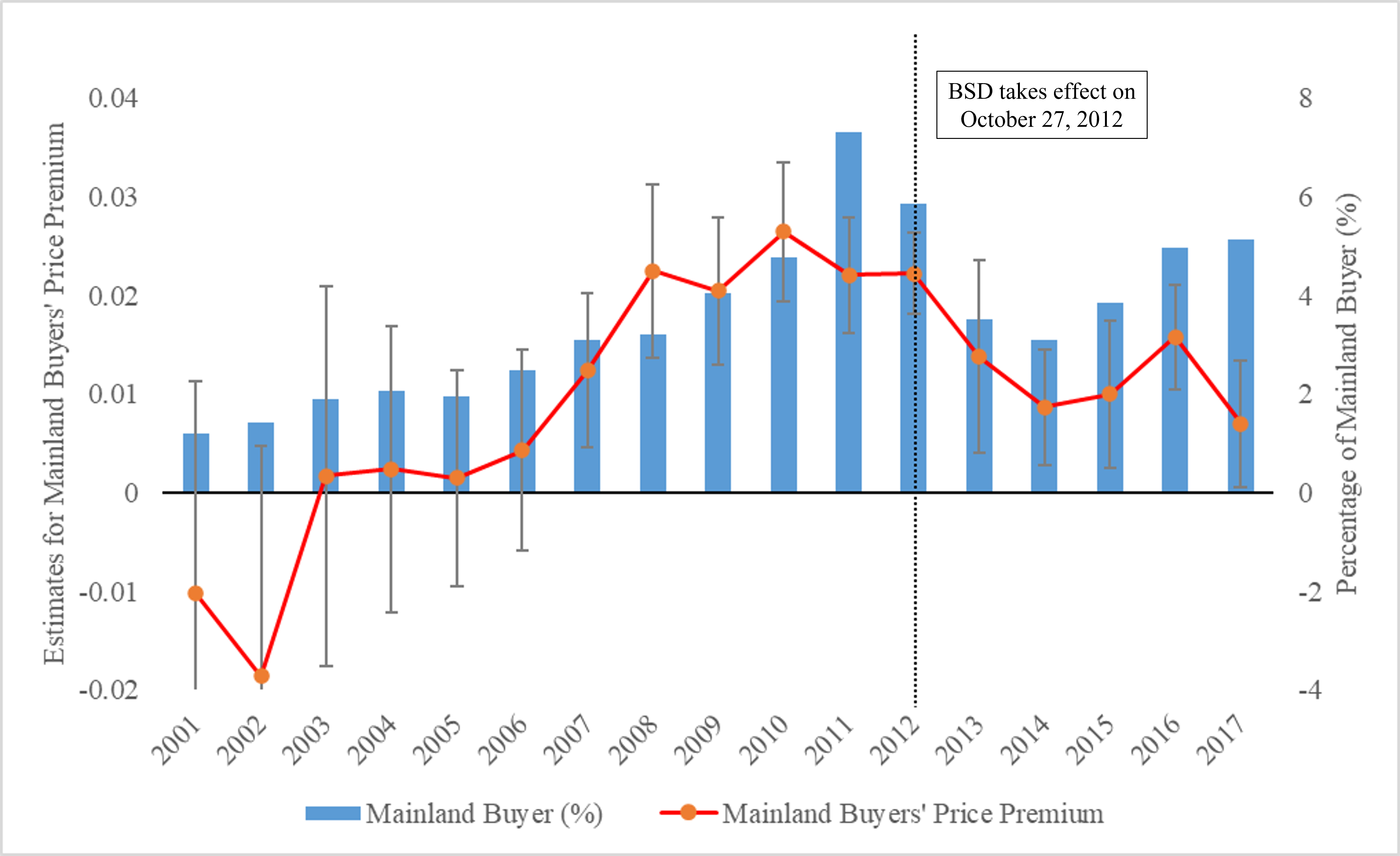

Using comprehensive housing transaction records from 2001 to 2017 in the Hong Kong housing market, this study investigates the role of mainland Chinese buyers on Hong Kong’s housing prices. Given the close geographic proximity and cultural similarity to mainland China, Hong Kong has been a popular destination for mainlanders. We find that mainland buyers pay an average price premium of 1.4% compared with locals. The premiums are estimated to be 3.5% for large-sized luxury units and 1.6% for homes in central locations.

We further explore three channels—hedging motive, residential sorting, and information barriers—to explain the price premiums. We show the hedging motive, which positively correlates with currency risk and economic uncertainty in mainland China, has the largest impact. Mainland buyers’ price premiums rise significantly when the Chinese currency depreciates or China’s economic policy uncertainty increases. Our findings imply that residential real estate in Hong Kong serves as an attractive hedging asset for mainland buyers—including migrant buyers living in Hong Kong—possibly because of the pegged exchange rate between the HKD and the USD and geographic proximity to mainland China.

Overall, our study adds to the growing literature on the impact and mechanism of the “China shock” on the global housing markets. We are among the first to study the impact of mainland Chinese buyers on the Hong Kong housing market, a primary destination of mainland China’s capital outflow. Mainland buyers’ price premiums (1.4%) in the Hong Kong housing market are comparable in magnitude to those (2.6% on average) of out-of-town investors in the Paris housing market, as documented by Cvijanovic and Spaenjers (2021). Our results shed light on the ongoing public debate on the role of mainland buyers in the Hong Kong housing market (Chu, 2012; Li, 2016; Shane, 2019), implying that the demand of mainland buyers is unlikely the major driving factor for the rapid and substantial housing price growth in Hong Kong over recent years.

Our study also contributes to uncovering the major channels through which foreign/cross-border buyers a?ect housing prices in host countries/regions. Among the channels we examine, we highlight mainland buyers’ hedging motives against currency risk and economic policy uncertainty in mainland China as a major mechanism for their price premiums in the Hong Kong housing market. This mechanism aligns with our finding that mainland buyers are unlikely to be the most important driver of the booming Hong Kong market all the time, as their demand varies with their hedging needs.

Figure