Michael D Eriksen, Chun Kuang, Wenyu Zhu

Review of Finance, Volume 28, Issue 5, September 2024, Pages 1663–1686, https://doi.org/10.1093/rof/rfad041

We identify a specific channel through which appraisers introduce bias in the estimated values of some individual properties. Virtually all appraisers of residential property are required to first select comparable transactions (or “comps”) of properties with similar attributes, then document differences in attributes between the subject property and selected comps to reach their opinion of value. By constructing a database of over 28 million sets of property attributes reported by appraisers associated with 4.6 million loan applications gathered by a large secondary market financial institution from 2013 until 2017, we test whether appraisers consistently misreport attributes of subject properties and the comparable transactions used to anchor their estimates.

Appraisers have an incentive to misreport property attributes to justify higher appraised values to ensure associated mortgage loans are approved. We focus on property transactions with multiple sets of attributes reported by the same appraiser and find evidence consistent with an intent to inflate valuations through attribute misreporting. In particular, some appraisers appear to strategically under-report the same comp when the contract price of the subject property exceeds its Automated Valuation Model (AVM) estimate. We interpret this as evidence consistent with under-reporting comp attributes being a strategy that some appraisers use to inflate appraised values for subject properties when they would otherwise be below contract prices and therefore jeopardize the transaction. We also find that highly leveraged borrowers whose appraisals had inconsistently reported attributes were 9.8% more likely to become seriously delinquent in their loan payments.

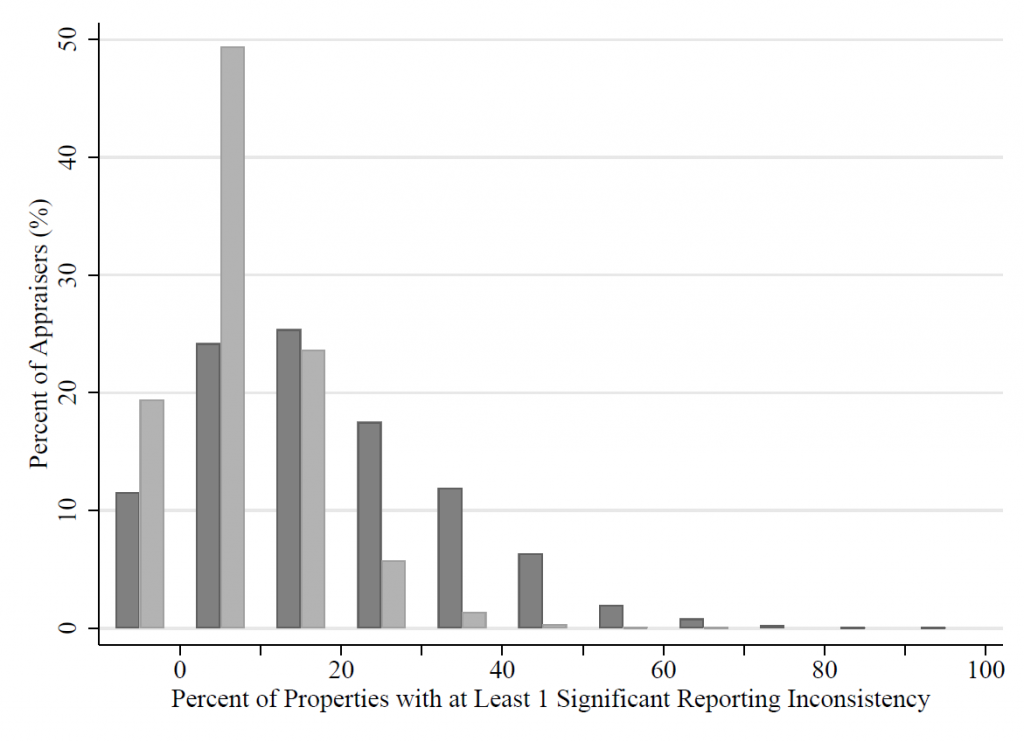

Strategic misreporting of attributes appears prevalent across markets. Figure 1 illustrates the distribution of appraisers by the share of appraisals with at least one significant reporting inconsistency. We only look at attributes reported for the same property by the same appraiser, with the dark grey bars representing the subject-comp comparisons and the light grey bars representing the repeated-comps comparison. Only 11.5% (19.4%) of appraisers for the subject-comp (repeated-comps) comparisons did not have a single instance of misreporting and are indicated by the bars left of 0. Almost one-third (31.2%) of appraisers who have reported attributes for the same comp across multiple appraisals significantly under-state at least one comp attribute on more than 10% of their appraisals.

While we show that misreporting is a tool used by some appraisers, it does not mean appraisers do not also use other harder-to-detect mechanisms to bias values. We conclude by discussing how appraiser-reported attributes of subject properties could be used to populate an auditable database at the national level to limit intentional reporting biases in the future