Meng Han, Lammertjan Dam, Walter Pohl

Review of Finance, Volume 29, Issue 2, March 2025, Pages 315–347, https://doi.org/10.1093/rof/rfae043

In financial markets, price variation generally reflects variation in discount rates rather than in expected cash flows, a pattern observed in many asset markets. An open question is whether this logic applies to commodity markets.

We show that commodity markets differ significantly from other asset markets. Commodity prices can still be viewed as reflecting the discounted value of future cash flows; however, prices strongly predict cash flows instead. This makes commodity prices much closer to the classical textbook view of price changes reflecting cash flow news.

From the point of view of a consumer of a commodity, it may seem peculiar to talk about the role of discount rates versus cash flows. If you operate an airline, a barrel of oil is purely a one-time cash outlay, and the only question is whether to determine the price now or later (i.e. whether to buy it on the spot or futures market). However, for an investor, commodities play a different role. Investors can trade commodities in both spot and futures markets to profit from price differences. Spot and futures prices do not move together perfectly, and the difference can be a reflection of news about the profitability of investing in this market, or how heavily investors discount. Experience in other markets suggests that the discount rate should dominate. It does not.

To explore this, we consider a trading strategy that turns a single commodity unit into an infinite series of cash flows. By repeatedly selling the unit and buying it again using futures contracts, the investor can collect the cash equivalent of net convenience yields. By net present value logic, the price of the commodity should equal the discounted sum of these yields, with price changes reflecting changes in expected yields, discount rates, or both.

We then apply a linearized present value model to commodity prices, similar to the Campbell-Shiller decomposition used for stocks. For equities, this model can reveal whether price-dividend ratios vary to predict future returns, dividend growth, or bubbles. However, applying this model to commodities is challenging because net convenience yields, the commodity equivalent of dividends, can be negative, complicating the log-linearization. To address this, we use the neglog transformation to generalize the Campbell-Shiller framework for negative yields. This approach preserves the economic meaning of negative yields.

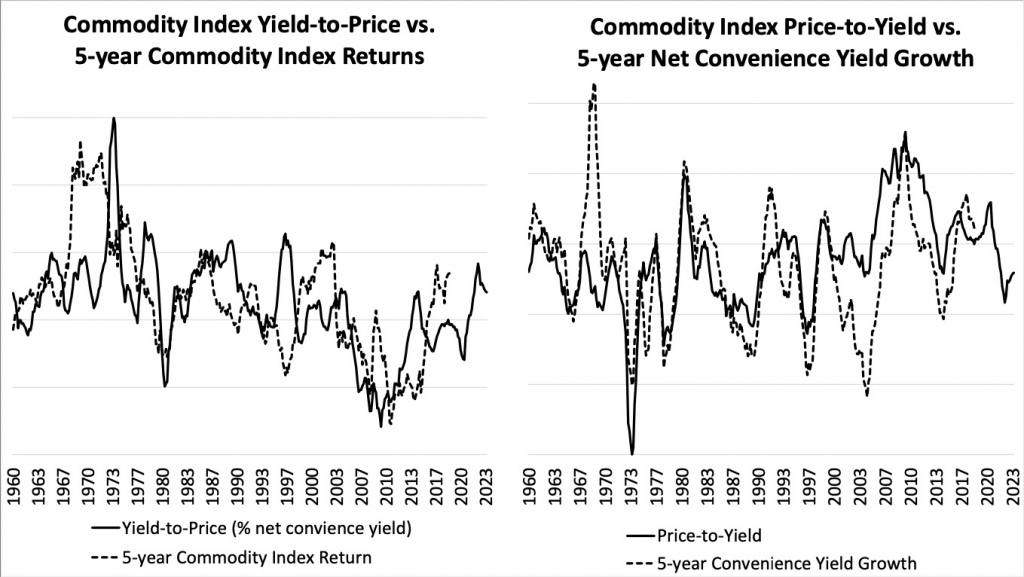

With this generalized model, we explore the relationships between commodity price volatility, returns, and yield growth using an index for 23 commodities from 1959 to 2024. The figure highlights the main findings, with on the left the current yield-to-price ratio (percentage net convenience yield) versus the following 5-year cumulative return; and on the right the price-to-yield ratio versus the following 5-year cumulative net convenience yield growth. We find strong predictability patterns in both returns and yield growth (correlation 43% and 61% respectively). Higher commodity prices predict higher expected net convenience yields and lower expected returns, with yield growth being more predictable than returns. Over the long run, however, variation in commodity prices is primarily driven (about 90%) by expected yield growth.