What Do Stock Markets Tell Us about Exchange Rates?

Review of Finance, Volume 20, Issue 3, 1 May 2016, Pages 1045–1080,https://doi.org/10.1093/rof/rfv032

An investor holding foreign equities is naturally exposed to exchange rate fluctuations. Both portfolio performance and foreign exchange (FX) risk hedging depend, among other things, on the relationship between equity and currency returns. But are equity and FX returns related at all? In a recent paper (Cenedese, Payne, Sarno, and Valente, 2016) we shed new light on this topic: we find that stock returns seem to tell us little, if anything, about the behaviour of exchange rates, and that FX risk does not matter much for global equity portfolios at long horizons.

We look at the relation between expected equity and FX returns from a cross-sectional asset pricing perspective. We consider an investor who builds a portfolio strategy designed to capture differences in expected returns across international equity markets in local currency, without hedging FX risk. We measure the returns from this strategy and we attribute them to components originating from the equity and the FX markets. This decomposition allows us to measure, and economically assess, the role of the correlation between equity and FX returns in a broad cross-section of countries

Our analysis is based on data for over 40 country-level equity indices observed over the past 30 years. The portfolio strategy we consider goes long markets that are predicted to rise and short markets that are predicted to fall (or to rise less) according to conventional predictors, such as dividend yields, momentum returns, and yield curve term spreads. We find that this strategy earns excess US dollar gross returns ranging between 7% and 12% per annum, depending on which of the three predictors are used. This result suggests that there are significant rewards available to international equity investors from betting on markets that are expected to perform well. It also sheds light on the portfolio implications of the correlation between FX and equity markets, as FX returns neither erode nor enhance the returns from the portfolio strategy. Overall, there is no evidence of a systematic relationship between equity returns in local currency and FX returns.

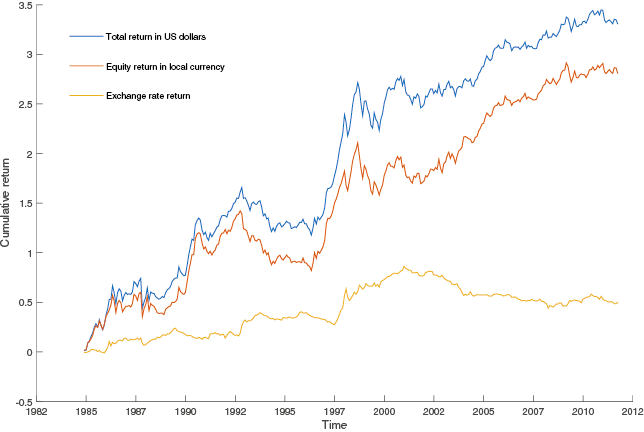

Figure 1 shows the cumulative returns from the strategy that uses past momentum returns as predictors for future equity returns. The total return over 28 years is close to 350%, decomposed in 300% originating from local market equity returns and 50% due to FX returns.

Do the documented high strategy returns reflect remuneration for risk? We show that our strategy generates high expected returns partly because it tends to pay off when global stock volatility is low, and it performs poorly when global stock volatility is high. However, we also find that signi?cant extra returns remain even after accounting for this and other traditional risk factors.

Figure 1.Cumulative returns from the international momentum strategy