Marianne Andries, Thomas M Eisenbach, R Jay Kahn, and Martin C Schmalz

Review of Finance, Volume 29, Issue 6, November 2025, Pages 1699–1720, https://doi.org/10.1093/rof/rfaf029

The risks facing investors have a rich term structure with some risks relevant at shorter maturities and other risks relevant at longer maturities. Understanding risk premia and their term structure, both unconditionally slopes as well as over time is therefore crucial.

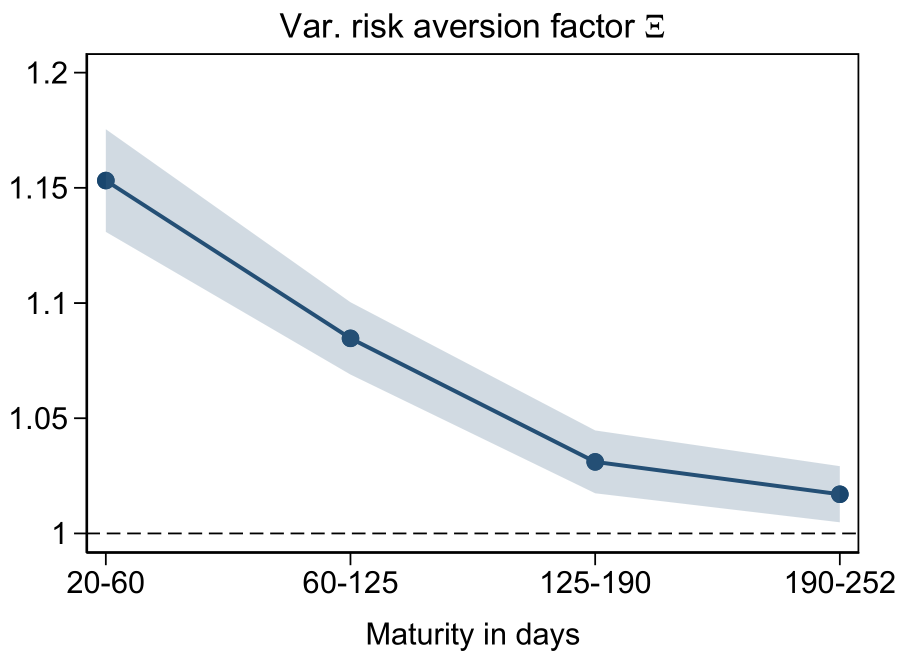

The goal of our paper is to deepen our understanding of the term structure of variance risk pricing and its variation over time with over 25 years of standard index options data, using both the structural framework of a parametric options pricing model as well as the robustness of a non-parametric approach. Estimating the aversion to variance risk separately for options of different maturities, we find that variance risk pricing decreases in absolute value with maturity but remains significantly different from zero up to the nine-month horizon. We find consistent non-parametric results using estimates from Sharpe ratios of delta-neutral straddles. We further show that the term structure is downward sloping both during normal times and in times of stress, when required compensation for variance risk increases and its term structure steepens further.

We then derive the pricing of variance forwards in our framework. Calculating the risk-neutral expected variance separately for each maturity bucket using the corresponding variance risk aversion parameters obtained in our parametric estimation results in an implied term structure of variance forwards strikingly similar to the one documented by Dew-Becker et al. (2017): a large jump from average realized variance to the average variance forward at the shortest maturity and then essentially flat at longer maturities. Letting variance risk pricing decrease with the horizon therefore allows us to reconcile the classical asset pricing stochastic volatility framework with the evidence in Dew-Becker et al. (2017), in the same way that the horizon-dependent risk aversion model of Andries, Eisenbach, and Schmalz (2024) reconciles the long-run risk model of Bansal and Yaron (2004) with the term-structure evidence of van Binsbergen, Brandt, and Koijen (2012).

Figure 1