The Effect of Regulatory Constraints on Fund Performance: New Evidence from UCITS Hedge Funds

Juha Joenväärä, Robert Kosowski

Review of Finance, Volume 25, Issue 1, February 2021, Pages 189 – 233, https://doi.org/10.1093/rof/rfaa017

In this paper we study the effect of regulatory constraints on fund performance and risk by comparing conventional and UCITS hedge funds. Using a matching estimator approach designed to overcome endogeneity biases, we estimate the indirect cost of UCITS regulation to be between 1.06% and 4.05% per annum in terms of risk-adjusted returns. These performance differences are likely to stem from UCITS constraints such as those governing eligible assets, diversification, and short selling, and cannot be explained by differences in redemption terms or level of leverage. We confirm that our performance results are not driven by management company characteristics, fund manager characteristics or unobserved confounder bias.

To understand the implications of regulatory constraints, we compare UCITS hedge funds to conventional hedge funds managed under the Dodd Frank Act or the AIFM Directive. Even though the origin of UCITS regulation is Europe, UCITS funds are recognized – and can be marketed – in at least 75 countries worldwide. The size of the UCITS hedge fund universe is around $420 billion, which is around one fifth of the $2.4 trillion hedge fund assets reported to seven commercial databases.

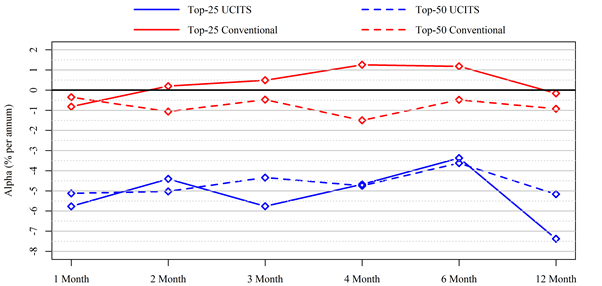

To illustrate our findings, in Figure 1 we report results from performance persistence tests. We sort the top 25 and top 50 funds into portfolios based on their past global net-of-fee alpha t-statistics that are estimated from the prior two years’ data during 2007-2016. Across rebalancing horizons ranging from 1 to 12 months, top 25 and top 50 fund performance is significantly higher for conventional funds.

In the paper we show that the top UCITS fund portfolios deliver alphas that are negative across all rebalancing horizons no matter whether they measured net-of-fees or gross-of-fees. This implies that performance chasing by UCITS investors would result in significant negative risk-adjusted returns. For conventional hedge funds, the net-of-fee alphas are close to zero, whereas their gross-of-fee alphas are positive. This suggests that managers that run conventional top funds extract all the economic rents.

Why do UCITS hedge funds exist in equilibrium if they underperform conventional hedge funds even after a careful matching estimator analysis.

Our findings support the view that UCITS regulation protects investors, and, therefore, some investors may prefer UCITS funds to better performing conventional hedge funds.

We document that management firms that have had relatively low past performance and experienced outflows are more likely to launch UCITS hedge funds. By doing so these companies are able to gather more capital flows because of investors’ high demand for more regulated and transparent products. However, we find that for some management companies (typically those that have had relatively good performance and not experienced outflows), it is optimal to run conventional funds since they are more profitable. Overall, our findings are consistent with an equilibrium in which management firms that experienced lower (higher) performance and flows maximize expected fees by launching and running UCITS (conventional) hedge funds.

Figure 1: Performance Persistence Differences between UCITS and Conventional Hedge Funds (2007-2016).