Signal on the Margin: Behavior of Levered Investors and Future Economic Conditions

Prachi Deuskar, Nitin Kumar, Jeramia Allan Poland

Review of Finance, Volume 24, Issue 5, September 2020, Pages 1039–1077, https://doi.org/10.1093/rof/rfaa006

Investor behavior, being forward-looking, ought to tell us something about the future. Empirically, however, linking investor behavior to future economic conditions requires a mechanism that separates investors into those who are more informed about the future and those who are not. Margin capacity, our new measure, uses such a mechanism to extract a signal based on the behavior of levered and potentially informed investors. It produces a powerful, significant, and identifiable return forecast that is substantially better than previously suggested predictors.

Our primary motivation comes from prior theoretical and empirical work on hedge funds showing that hedge funds decrease leverage in anticipation of lower returns or higher risk. Like hedge funds, other plausibly informed levered investors are likely to be cautious ahead of bad times. Thus, margin capacity, defined as the aggregate excess debt capacity of investors buying securities on margin, is likely to be a pessimistic signal of things to come.

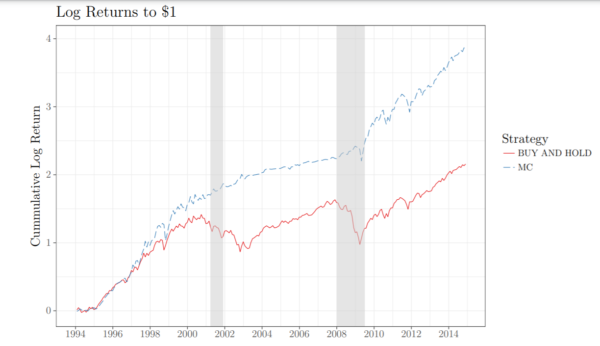

Indeed, margin capacity (MC) strongly predicts lower S&P 500 returns. A one-standard-deviation increase in MC is associated with a 1.11% lower market return in the next month. More importantly, MC largely encompasses all information contained in the other return predictors. Correspondingly, an MC-based out-of-sample investment strategy delivers large investment gains. The figure below shows returns to this strategy and to a buy-and-hold S&P 500 strategy.

Figure 1: Cumulative returns to $1: mean-variance investor This figure plots cumulative returns (sum of logs) for the out-of-sample strategy of a mean-variance investor with relative risk aversion coefficient of three who allocates between equities and risk-free T-bills using S&P 500 excess return forecast based MC. MC is the detrended ratio of margic capacity to GDP. The equity weight is constrained to lie between –0.5 and 1.5. Buy and hold corresponds to the investor passively holding the market portfolio. See Section 3 of the paper for the detailed variable definitions and Appendix A.3 for the details of asset allocation.

MC also predicts (a) lower growth in aggregate earnings, dividends, employment, and overall economic activity, (b) higher macro, financial, and policy uncertainty, (c) lower interest rates, (d) tighter lending standards by banks, and (e) lower intermediary equity capital.

Our study contributes to three strands of literature in the macro-finance area. First, we show that the behavior of a subset of potentially informed investors acts as warning signs for many dimensions of the macroeconomy, adding to the literature that has used financial market signals to predict macroeconomic variables. Second, we establish that margin capacity is not driven by intermediary or borrowing constraints but, in fact, precedes them. Thus, our study introduces a predictor for the conditions which the intermediary asset pricing literature identifies as a key determinant of asset prices. Third, a recent strand of the literature shows that an increase in the aggregate levels of debt in the economy precedes poor macroeconomic outcomes. We complement this literature by showing that margin investors reduce leverage ahead of higher risk and lower economic growth.