Sentiment in Central Banks’ Financial Stability Reports

Ricardo Correa, Keshav Garud, Juan M Londono, Nathan Mislang

Review of Finance, Volume 25, Issue 1, February 2021, Pages 85–120, https://doi.org/10.1093/rof/rfaa014

We use the text of financial stability reports (FSRs) published by central banks to analyze the relation between the sentiment they convey and the financial cycle. We construct a dictionary tailored specifically to a financial stability context, which classifies words as positive or negative based on the sentiment they convey in FSRs. With this dictionary, we construct financial stability sentiment (FSS) indexes for 30 countries between 2005 and 2017. We find that central banks’ financial stability communications are mostly driven by developments in the banking sector. Moreover, the sentiment captured by the FSS index explains movements in financial cycle indicators related to credit, asset prices, systemic risk, and monetary policy rates. Finally, our results show that the sentiment in central banks’ communications is a useful predictor of banking crises—a 1 percentage point increase in FSS is followed by a 29 percentage point increase in the probability of a crisis.

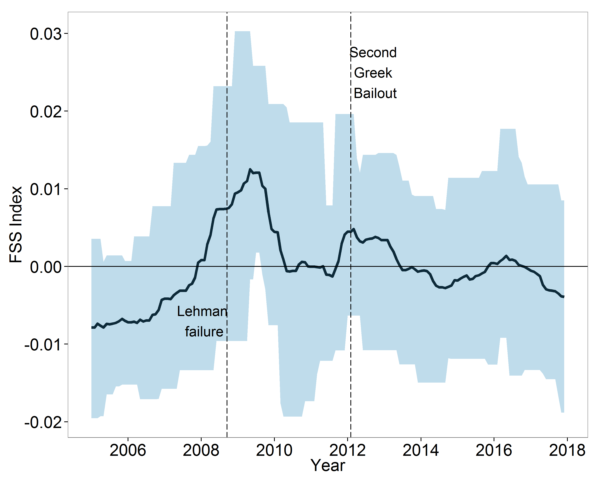

Figure 1

The figure shows the equally-weighted average of all countries’ demeaned FSS indexes (the bold line). We also show the range of demeaned FSS indexes for all countries in our sample (the shaded area). To calculate the quarterly average and range, for each country, we assume a step function to interpolate between any two dates with FSRs available.