Responsible Hedge Funds

Hao Liang, Lin Sun, Melvyn Teo

Review of Finance, Volume 26, Issue 6, November 2022, Pages 1585–1633, https://doi.org/10.1093/rof/rfac028

This paper sheds light on the investment implications of endorsing the United Nations Principles for Responsible Investment (PRI) by analyzing hedge funds. An integral part of the portfolios of responsible institutional investors, hedge funds are particularly susceptible to agency problems and prone to opportunistic behavior given their low levels of transparency, disclosure, and regulatory oversight.

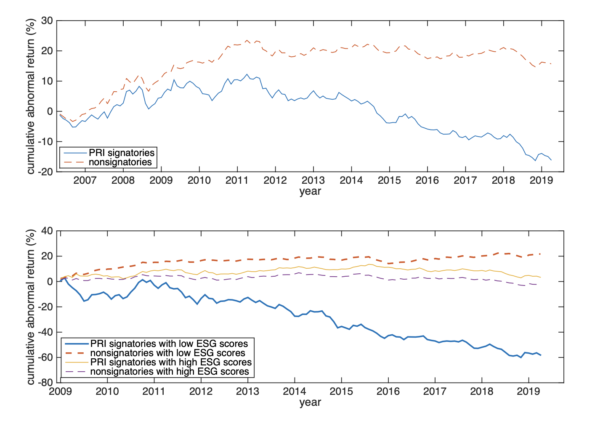

We show that hedge funds that endorse responsible investment underperform those that do not after adjusting for risk. PRI signatory funds do not underperform because of their greater exposure to responsible firms. Rather, the underperformance is driven by PRI signatories with low exposure to such firms.

Consistent with the agency view, the underperformance of signatory (and low-ESG signatory) funds is stronger when the incentives of fund managers and investors are misaligned. Moreover, in line with the agency story, low-ESG signatories exhibit other forms of managerial opportunism. They are more likely to trigger regulatory, investment, and severe violations, and more likely to display suspicious patterns in reported fund returns that are potential indicators of fraud.

To tackle endogeneity concerns, we show that following the adoption of stewardship codes, which mitigate agency problems, both the ESG exposure and relative performance of signatory funds improve. As an agency story would predict, the results are stronger for low-ESG signatory funds than for high-ESG signatory funds.

We show further that hedge funds that endorse responsible investment reap tangible and pecuniary benefits. Funds that endorse responsible investment attract substantially larger inflows than do other funds. Investors do not on average discriminate between low- and high-ESG signatories. Low-ESG signatories attract investment flow by promoting their funds more aggressively and marketing to unsophisticated investors who are less able to accurately assess ESG exposure.

In an out-of-sample test, we study actively managed mutual funds. Given their higher levels of transparency, disclosure, and regulatory oversight, which curb agency problems, we expect to find weaker results for mutual funds. Nonetheless, for mutual funds with poor incentive alignment, we still find that those managed by signatories (and by low-ESG signatories, especially) underperform, suggesting that agency problems also drive fund underperformance for signatory mutual funds.

Figure: Cumulative abnormal returns of hedge funds sorted on PRI endorsement and firm ESG scores