Regulatory Sandboxes and Fintech Funding: Evidence from the UK

Giulio Cornelli, Sebastian Doerr, Leonardo Gambacorta, Ouarda Merrouche

Review of Finance, Volume 28, Issue 1, January 2024, Pages 203–233, https://doi.org/10.1093/rof/rfad017

The rapid growth of innovative companies in the financial sector has the potential to foster competition, leading to efficiency gains and more choice for consumers. However, fintechs often struggle to raise enough capital to develop products and expand, as they offer novel products in an environment of high regulatory uncertainty. Policymakers around the world are thus stepping up their efforts to facilitate fintechs’ access to financing and promote competition in the financial sector.

A landmark initiative was the creation of the “regulatory sandbox” by the United Kingdom’s Financial Conduct Authority (FCA) in 2015. The sandbox offers fintechs a controlled testing environment in which they can try out their products on a limited set of customers. Regulators, in turn, can gain insights about new financial technologies and emerging trends, and identify associated risks before products are launched for the mass market. By now, over 50 countries have followed the UK and introduced their own regulatory sandbox.

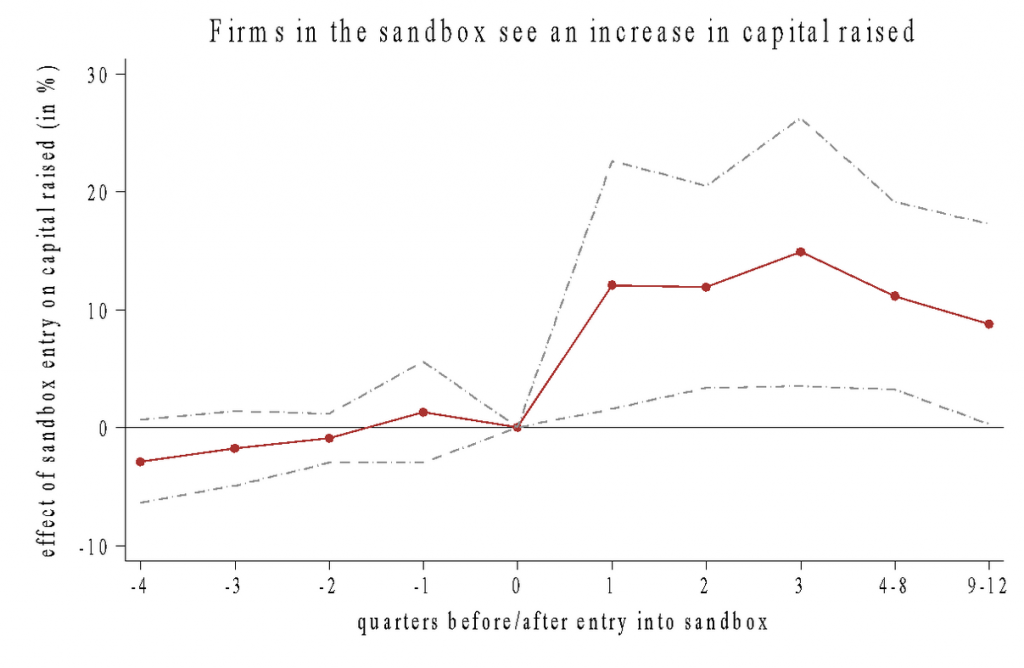

In our paper, we show that entry into the FCA regulatory sandbox is followed by significant increase in capital raised and improved operational outcomes. Specifically, firms that enter the sandbox experience a 15% increase in capital raised (or $700,000) over the following two years, relative to firms that enter the sandbox at a later date. Firms’ probability of raising capital increases by 50%. Moreover, we find that sandbox firms are not only significantly more likely to still be in operation today, but also to patent substantially more than comparable firms.

What are the underlying mechanisms? For one, sandboxes could curb informational frictions through regulatory oversight and continuous dialogue between firms and the regulator. This could offer reassurance to investors that firms meet their regulatory obligations. Additionally, advice by trained case officers could lower regulatory costs for firms and reduce the risk of offering products in violation of the regulatory framework.

The evidence supports the notion that the sandbox reduces information asymmetries between investors and firms, as well as costs associated with regulatory uncertainty. We first show that the positive effect of sandbox entry on capital raised is stronger for smaller and younger firms, which are more opaque and hence subject to severe informational frictions. Second, entry into the sandbox is associated with greater increases in deal volume for venture capital deals, which are generally more information-sensitive. Third, firms in the sandbox raise more capital especially from foreign and first-time investors, ie those that likely face higher information asymmetries. Finally, we show that firms with a CEO who has a background in financial law raise relatively less capital after entry into the sandbox.

All in all, our paper provides the first systematic evidence that sandboxes help fintechs to raise capital and innovate. Sandboxes, which have already been adopted by numerous countries around the world, could hence become a useful policy tool for harvesting the benefits of financial innovation.

Figure 1