Lykourgos Alexiou, Amit Goyal, Alexandros Kostakis, Leonidas Rompolis

Review of Finance, Volume 29, Issue 4, July 2025, Pages 963–1007, https://doi.org/10.1093/rof/rfaf016

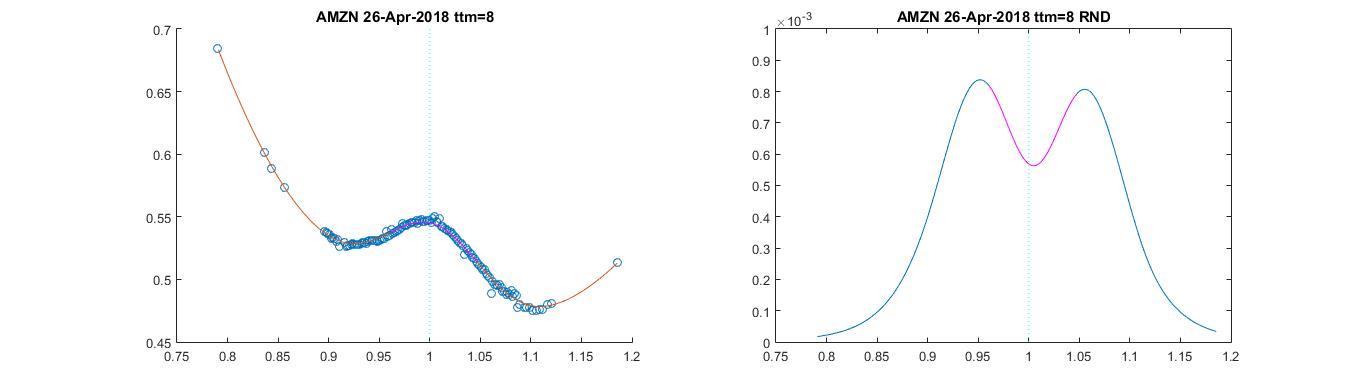

We document that the implied volatility (IV) curves of equity options frequently exhibit concavity prior to the earnings announcement dates (EAD). This shape is in stark contrast with the convex volatility smiles or smirks that are commonly observed for equity options. Concavity is most obvious in short-expiry options, it typically reflects a bimodal risk-neutral density (RND) for the underlying stock price, and quickly disappears after the announcement, as the uncertainty surrounding this event is resolved. As an example, the figure below shows the IV curve (left panel) and the corresponding RND (right panel) for Amazon, computed from options with 8 days to expiry on April 26, 2018, i.e., just before its quarterly earnings announcement.

Despite the larger than average stock price moves on EAD following the formation of concave IV curves, we still find that the corresponding delta-neutral straddle returns are significantly lower than those for non-concave IV curves. We further show that concave IV curves are followed by large negative strangle and delta- and vega-neutral straddle returns on EADs, revealing that investors seek to hedge the gamma, rather than vega, risk that arises due to this corporate event.

Overall, we show that investors can ex-ante identify the announcements that trigger larger than average stock price moves, and they pay a substantial premium to hedge against this event risk. This hedging activity impacts option prices, leading to the formation of a concave IV curve. We conclude that concavity in the IV curve constitutes an ex-ante option-implied signal for event risk in the underlying stock arising due to the impending announcement.

The focus of our study is on scheduled corporate earnings announcements. However, our model as well as the empirical methodology can be applied to any type of scheduled announcement that may trigger large asset price moves.