New Mortgage Lenders and the Housing Market

Nikodem Szumilo

Review of Finance, Volume 25, Issue 4, July 2021, Pages 1299–1336, https://doi.org/10.1093/rof/rfaa031

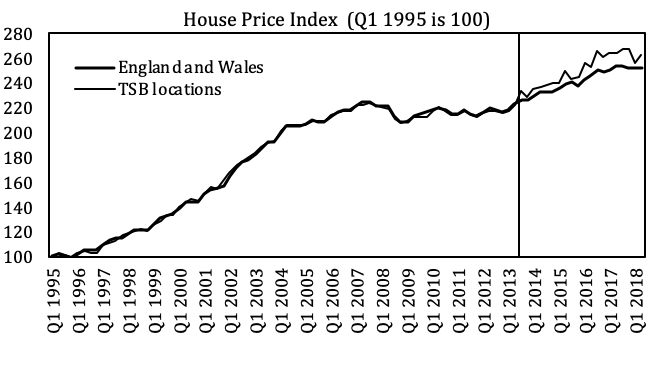

This paper examines the effect of a new lender’s entry into a local mortgage market on the supply of new loans, housing prices and repossessions in areas around its branches. I use the decision of the European Commission to force the UK’s largest retail bank to divest a part of its business as a shock to the entry of a new lender, and show that incumbent banks increase mortgage lending in areas where the new bank has its branches. Further, house prices increase by around 5% in the real estate market impacted by the shock. Average transaction numbers and mortgage repossession rates also increase in places where the new bank enters. Overall, my results show that increased competition in the banking market can have adverse consequences for risk-taking and financial stability. The attached figure shows that house prices in places that received a branch of the new bank (TSB locations) followed the same trends as the rest of the country for almost 20 years before they diverged at the time of the treatment.

Figure 1: House Price Index