Xiaoqiao Wang, Jing Xie, Bohui Zhang, and Xiaofeng Zhao

Review of Finance, Volume 29, Issue 6, November 2025, Pages 1833–1870, https://doi.org/10.1093/rof/rfaf044

Can a Simple Nudge Change Corporate Payout Policy?

Conventional wisdom holds that a firm’s dividend policy is a carefully calculated, stable decision reflecting deep strategic intent. But how firm are these convictions? We conducted a large-scale field experiment to see if a simple, unsolicited communication from an “investor” could influence the payout decisions of publicly listed firms.

Our study targeted over 2,500 Chinese firms during the critical window when their annual dividend plans are proposed. On a randomized basis, firms received brief messages framed around the core logic of four prominent dividend theories:

- Agency Theory: Highlighting investor concerns about managers misusing excess cash.

- Bird-in-Hand Theory: Emphasizing a preference for certain dividends over risky capital gains.

- Signaling Theory: Noting information gaps about the firm’s true profitability.

- Tax-Clientele Theory: Querying the firm’s dividend tax policies.

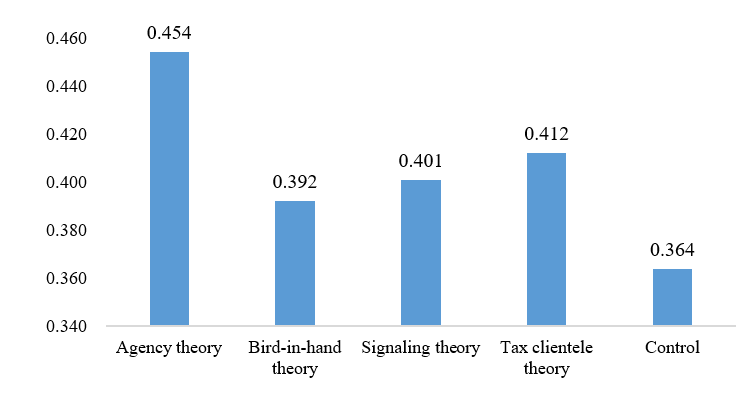

The findings were striking. The messages framed around agency concerns had a significant impact on corporate behavior. Firms that received these messages were substantially more likely to increase their dividend payouts compared to control groups. As shown in Figure 1, the fraction of past dividend-paying firms that increased their dividend yield is 45 percentage points—a 25% increase relative to the control group (36 percentage points)—after receiving the agency-themed message.

In contrast, messages based on the bird-in-hand, signaling, and tax-clientele theories had no statistically significant effect. The impact of the agency message was concentrated among firms that had paid dividends in the past and was even stronger for firms with weaker corporate governance (e.g., higher executive pay, fewer independent directors, and less external monitoring).

These results suggest that dividend policy is more malleable than traditionally assumed. While managers may not respond to abstract arguments about risk or taxes, they are sensitive to communications that heighten their awareness of investor concerns about potential resource mismanagement and the need for shareholder discipline. Our study demonstrates that even a light-touch intervention can causally influence major corporate financial decisions, highlighting the pivotal role of managerial perceptions and direct investor communication.

Figure 1: Fraction of Firms Increasing Dividend Yield After Treatment