Informed Trading and Momentum in the Corporate Bond Market

Lifang Li, Valentina Galvani

Review of Finance, Volume 25, Issue 6, November 2021, Pages 1773–1816, https://doi.org/10.1093/rof/rfab004

This study is the first attempt to explore the mechanism underlying the momentum effect in the corporate bond market. Using TRACE data, we provide direct evidence showing that informed trading is the driving force of the momentum effect. We exploit the informational heterogeneity among the outstanding bonds of a firm, which stems from informed investors distributing their trades unevenly over issues. As institutional investors pay more attention to news than retail investors and may have access to privileged information, our conjecture is that bonds attracting the bulk of institutional trades (i.e., top bonds) are informationally more efficient than the remaining bonds (i.e., non-top bonds). We verify that top bonds indeed attract higher informed trading levels and transmit information faster than non-top bonds. The identification of top and non-top bonds is performed at the issuer level to control for default risk and other issuer characteristics while eschewing discussions over the nature of the private information being diffused.

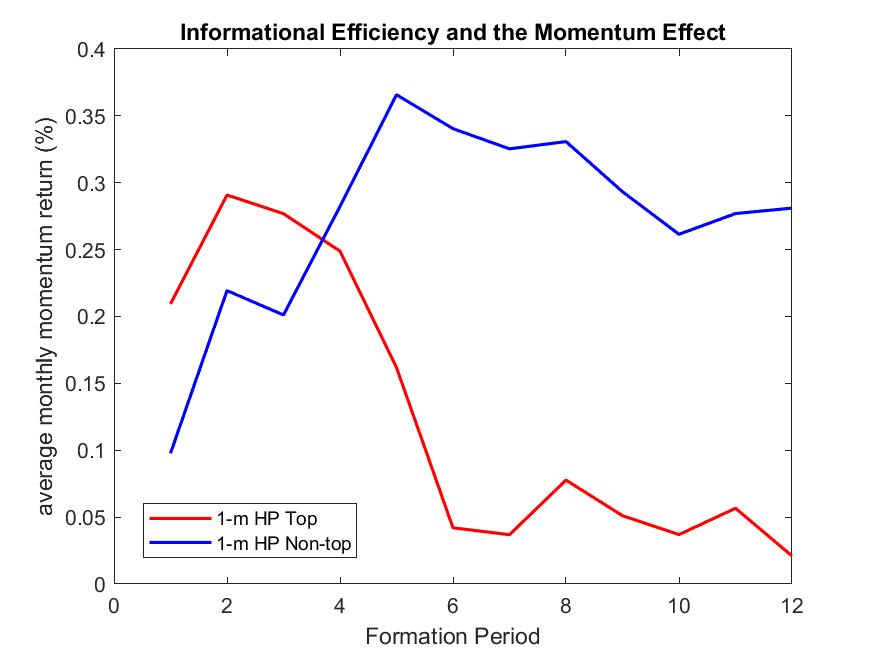

Building on these findings, we examine momentum profitability in top and non-top bonds and find that fast news spreading causes short-lived and low-peaked momentum in top bonds. In contrast, slow information diffusion in non-top bonds yields long-lasting and high-peaked momentum returns. Further, we document that the differences in the momentum patterns of top and non-top bonds are concentrated in bond-level information-intensive periods, which confirms the role of informed trading in originating the momentum effect. Figure 1 illustrates the relationship between informational efficiency and the momentum effect using top and non-top bonds.

This study also explains the role of illiquidity in generating the momentum effect. Bond-level liquidity affects momentum only by altering the speed at which news spreads, with lower liquidity entailing slower information diffusion and thus stronger momentum returns. However, illiquidity does not directly cause the momentum effect when there is little information to be imbued into prices.

Importantly, our findings provide an explanation for the documented concentration of the momentum effect in non-investment-grade (NIG) and private-issuer bonds, as information asymmetries are severe in these samples. Consistently, the distinctive momentum patterns in top and non-top bonds remain highlighted in the NIG and private-issuer bond groups. In contrast, there is no momentum for both top and non-top bonds in the investment-grade and non-private-issuer bond samples.

Figure 1: The figure plots the average monthly returns, in percentage terms, on momentum strategies in top and non-top bonds with a one-month holding period and formation periods ranging from one to twelve months.