Franklin Allen, Patrick Behr, Riccardo Cosenza, and Eric Nowak

Review of Finance, Volume 30, Issue 1, January 2026, Pages 321–349, https://doi.org/10.1093/rof/rfaf059

This study examines how investors react to firms’ engagement in biodiversity-related activities through voluntary carbon offsetting, focusing on forestry carbon projects worldwide. Using a novel, hand-collected dataset that links carbon credit retirements to publicly listed firms, the paper analyzes how the stock market responds to announcements that companies have retired carbon credits, particularly those under the Climate, Community & Biodiversity (CCB) Standard, which certifies additional biodiversity and local community benefits.

Voluntary Carbon Markets (VCM) allow companies to offset emissions through nature-based projects such as reforestation or avoided deforestation. While these projects are central to firms’ net-zero strategies, the credibility of offsets has come under increasing scrutiny. The paper exploits a market-wide shock arising from a Guardian investigation in January 2023 that claimed over 90 percent of rainforest carbon offsets were “worthless.” This media event sharply questioned the environmental integrity of the VCM, providing a quasi-exogenous shock to test how investors reassess the credibility of firms’ offsetting behavior.

The authors combine registry data from Verra, Gold Standard, Climate Action Reserve, and American Carbon Registry with Bloomberg stock prices to perform an international event study from 2009 to 2024. The sample covers 781 listed firms and 3,072 retirement announcements, representing over 116 million tons of CO2 offsets. Event-study regressions based on the Fama–French three-factor model measure cumulative abnormal returns (CARs) around each retirement announcement, comparing firms using CCB-certified credits with those relying on non-certified forestry credits.

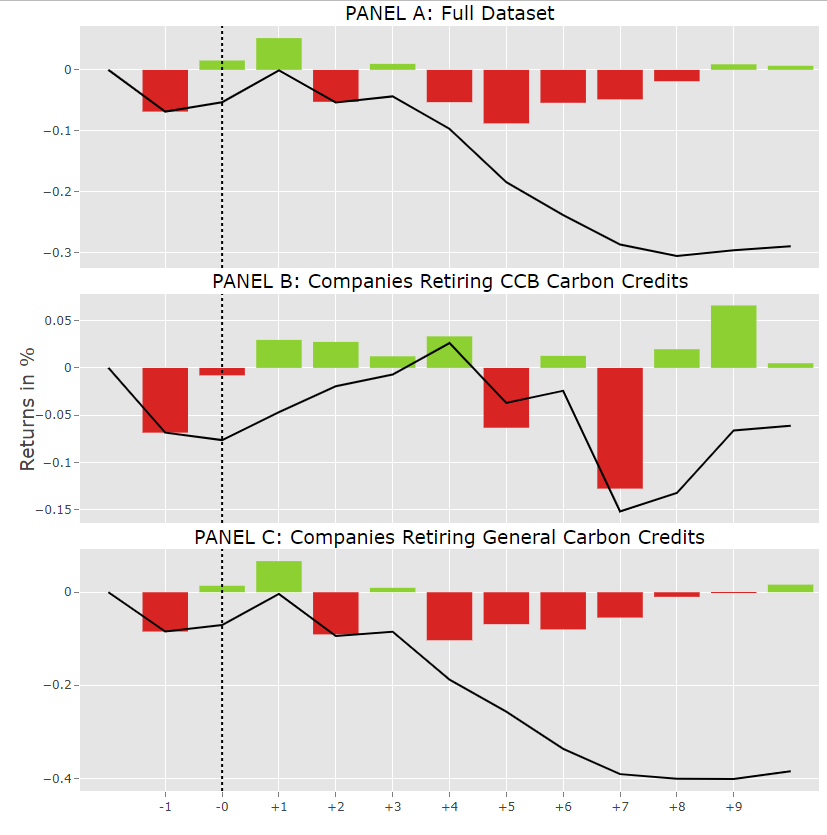

Before 2023, investors generally reacted neutrally to carbon credit retirements, suggesting that offsetting announcements neither enhanced nor harmed firm value. However, after The Guardian’s report, stock market reactions turned significantly negative for firms retiring standard forestry credits. In contrast, retirements of CCB-certified credits, those signaling biodiversity and community co-benefits, did not experience significant negative reactions. The difference indicates that investors distinguish between offsets of varying environmental credibility: biodiversity-linked, independently verified offsets mitigate concerns about “greenwashing” and preserve investor confidence.

Sectoral and regional analyses show that negative reactions were strongest for mining and manufacturing firms and for companies operating in South and Central America, regions closely associated with rainforest projects. Financial and service-sector firms displayed more muted or even neutral responses. Cross-sectional regressions confirm that CCB certification systematically reduces negative abnormal returns, while firm size and traditional financial ratios have limited explanatory power.

Overall, the findings reveal that markets are attentive to the quality and integrity of corporate climate actions. High-quality offsets with certified biodiversity benefits act as reputational insurance, whereas lower-quality credits can trigger investor skepticism, especially under public scrutiny. The results underscore the growing importance of credible environmental standards in VCMs and suggest that investors value transparency and measurable biodiversity impact.

Figure 1: Results for the entire sample

This figure shows the abnormal and cumulative abnormal returns for the full dataset (Panel A), companies retiring CCB–labeled carbon credits (Panel B), and companies retiring general carbon.