Marco Pagano and Luca Picariello

Review of Finance, Volume 29, Issue 2, March 2025, Pages 349–379, https://doi.org/10.1093/rof/rfae042

This paper explores the impact of corporate governance standards on firms’ hiring and promotion policies, focusing on meritocracy versus power retention by entrepreneurs. Effective corporate governance can influence firms to adopt meritocratic practices, promoting skilled employees based on merit rather than favoritism. This alignment between corporate governance and merit-based policies improves firm productivity and attracts high-skill workers, which benefits not only the individual firm but also the broader economy by enhancing workforce skill levels and job-market alignment.

The authors propose a model in which entrepreneurs may choose non-meritocratic promotions to retain control, despite the cost of reduced efficiency and profitability. External financiers anticipate these costs and offer less favorable terms to firms that prioritize power retention over merit. Similarly, high-skill workers prefer meritocratic firms, as these companies provide better promotion and pay prospects. Consequently, firms that follow meritocratic principles are more likely to attract skilled labor, which increases both their individual productivity and overall market efficiency.

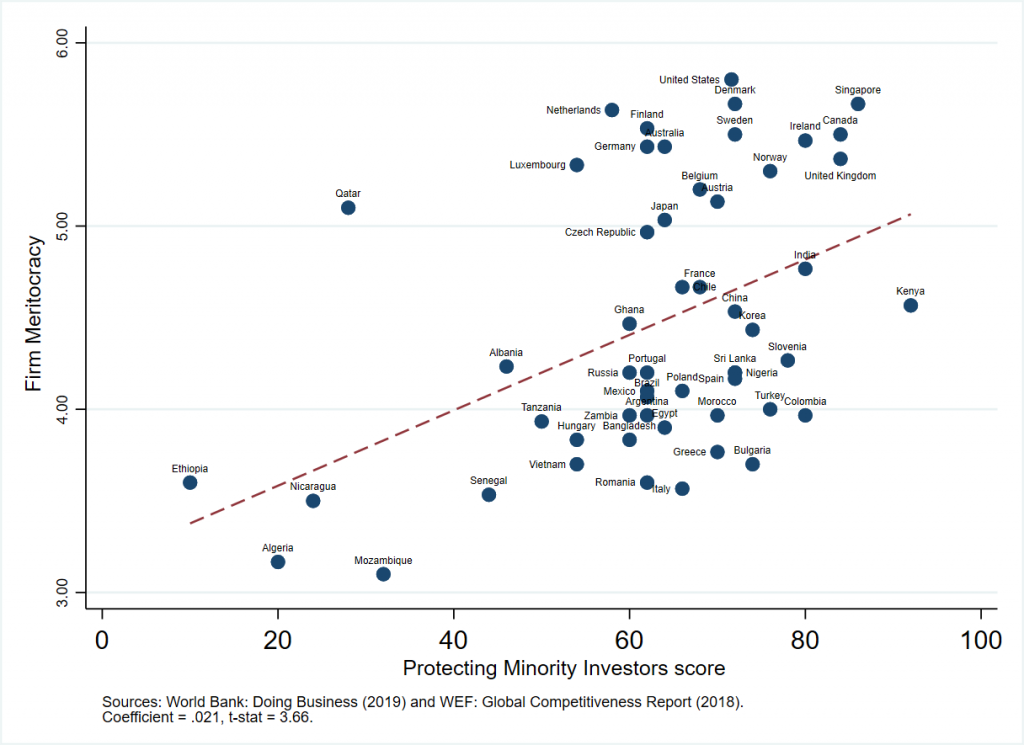

The paper shows that the labor market features a unique sorting equilibrium, where skilled employees gravitate toward firms with strong corporate governance standards and merit-based advancement, while firms with weaker governance attract unskilled workers. The better are corporate governance standards, the greater is the number of firms with meritocratic promotions, and therefore the larger is the number of workers whose career advancement rests on merit. The evidence shown in Figure 1 is consistent with the model’s prediction that governance standards should correlate with meritocratic practices: in countries with strong corporate governance (as measured by the World Bank’s Protection Minority Investors score) firms prioritize merit in promotions (based on an index built from the WEF Global Competitiveness report).

However, meritocratic promotion requires firms to offer higher incentive pay to motivate skilled managers, which can limit the profitability of merit-based promotions in the presence of severe agency problems. Offering incentive pay to skilled managers has an ambiguous effect on workers’ skill acquisition: higher pay upon promotion increases their incentives to acquire skills, but raises the cost of promoting skilled workers, thus reducing the fraction of meritocratic firms and thereby the promotion probability for skilled workers. As a result, the severity of managerial moral hazard may turn out to either increase or decrease the equilibrium fraction of skilled workers in the economy.

The model predicts that moderate improvements in governance standards only benefit firms where entrepreneurs place sufficiently low value on private benefits of control, while they damage entrepreneurs that value such benefits greatly. Hence, such reforms do not generate Pareto improvements. In contrast, extreme reforms enforcing universal merit-based promotions could lead to a Pareto improvement by aligning all firms with efficient practices. As a result, drastic governance reforms might gain broader political support than moderate ones.

Overall, the paper argues that corporate governance standards play a role in shaping not only firm-level meritocracy but also broader social welfare, productivity, and skill acquisition patterns.