Christoph Merkle, Michael Ungeheuer

Review of Finance, Volume 29, Issue 5, September 2025, Pages 1397–1436, https://doi.org/10.1093/rof/rfaf028

Our study examines how investors perceive the sensitivity of their stock portfolios to overall market movements—commonly measured by market beta—using data from four large-scale online experiments. Participants either actively select stocks from the Dow Jones Industrial Average (DJIA) or are randomly assigned portfolios from the same index. They report their expectations for portfolio returns conditional on various hypothetical market returns, enabling us to estimate their implied beliefs about beta.

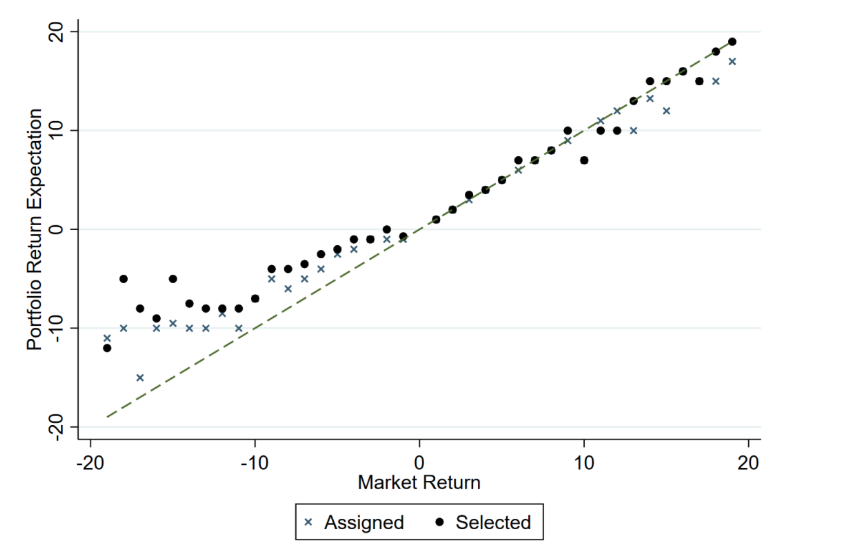

The main finding is that investors significantly underestimate the systematic risk (beta) of their portfolios, especially downside beta, i.e., the extent to which their portfolios fall with declining markets. This asymmetry is particularly pronounced for investors who actively select their portfolios: they believe their portfolios strongly participate in market gains but show relative protection against market losses. Specifically, participants who choose their own portfolios expect downside beta values averaging approximately 0.5, compared to upside betas closer to 0.8. The figure demonstrates this kink in expectations, showing investors’ expectations to outperform when market returns are negative.

Across four experiments—including incentivized elicitation, alternative questioning formats, and replication among financial professionals—the results consistently show that investors expect higher returns and lower risk for portfolios they actively select compared to randomly assigned portfolios. Participants’ biased beliefs regarding beta hold across different investor groups and elicitation methods, confirming the robustness of biased beliefs about beta.

We establish by the analysis of historical market data and realized outcomes that investor beliefs about downside protection and upside participation lack empirical support, suggesting these beliefs are driven by overconfidence and cognitive biases rather than an ability to pick low (downside) beta stocks.

Overall, our findings show a biased understanding of systematic market risk. Investors perceive their selected portfolios as offering upside potential and substantial downside protection. These results question whether investors can correctly interpret market news and are capable to hedge systematic risks effectively. It is possible that such beliefs contribute to the flat security market line of beta-sorted portfolios.

Figure 1 (See figure 4 in the manuscript): Conditional Expectations. The figure shows median conditional portfolio expectations for provided market returns. Medians are computed separately for participants in the selection treatment (black dots) and in the assignment treatment (blue crosses). Conditional expectations are based on the unassisted question format as shown in Figure 3 (in the manuscript), except for market returns of ±1% and ±10%, which are based on the assisted question format (see Figure 2 of the manuscript). Each group median in the figure is based on about 90 observations in the range ±2% to ±9% and 40 observations in the range ±11% to ±19%. This is due to the more frequent draw of smaller market returns. The dashed line represents a 45-degree line, which is at the same time the objective conditional expected return for an average randomly assigned portfolio.