Downside Market Risk of Carry Trades

Victoria Dobrynskaya

Review of Finance, Volume 18, Issue 5, 1 August 2014, Pages 1885–1913, https://doi.org/10.1093/rof/rfu004

According to uncovered interest parity, free capital mobility ensures that investments in different currencies with different levels of local interest rates do not consistently generate excess returns because a positive interest rate differential should be compensated by the expected exchange rate depreciation of the target currency. In reality, however, investments in high-interest currencies consistently generate higher excess returns than investments in low-interest currencies. This empirical ‘anomaly’ has led to the growing popularity of carry trades – an investment strategy in which an investor borrows in low-interest currencies and invests in high-interest currencies.

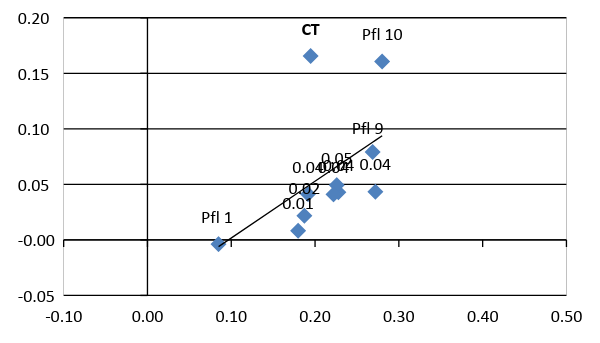

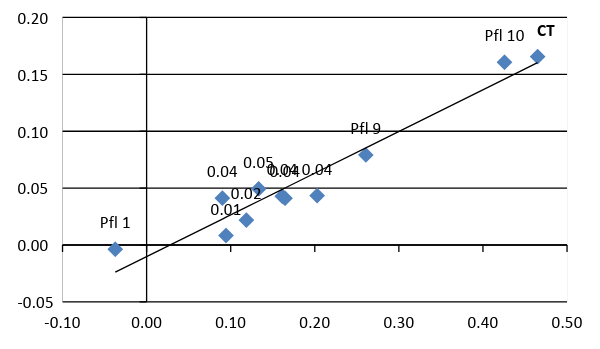

Are the high carry trade returns a ‘free lunch’? This paper shows that they are not! I propose the global downside market risk factor to explain the currency returns. When we examine the downside market risk of interest-rate-sorted currency portfolios, we observe a clear risk-return relationship (see the figure). High-interest-rate currencies have high and statistically significant downside market risk, which is measured by the downside beta, the ‘disaster beta’ or the coskewness with respect to the global stock market return; by contrast, low-interest-rate currencies have almost zero downside risk and, hence, can serve as a hedging instrument. The downside market beta of the long-short carry trade portfolio is several times higher than the regular market beta, especially if we measure it in the worst states of the world (e.g., when there is a market crash or a disaster event).

In theory, the downside beta is a better measure of risk compared to the regular market beta because it shows the covariance of an asset’s return with the market in the worst states of the world when the overall market performs poorly and when the marginal utility of investors is high. If an asset also yields losses in such states, then it is highly unattractive and should provide high expected returns. Indeed, I show that the downside risk has a much higher explanatory power for cross-sections of returns in the currency and equity markets than the overall market risk.

The estimates of the downside risk premiums are similar in the currency and equity markets suggesting that the high excess returns to carry trades are not a ‘free lunch’ but rather a fair compensation for their high downside market risk.

The results are robust to different levels of diversification within carry trade portfolios, different econometric methods employed, different cut-off levels for the downside betas, different samples of countries and different time periods. My downside market risk factor also wins the ‘horse race’ between alternative risk factors previously proposed in the literature on carry trades. The results are even stronger in the first decade of the 21st century – a period of rising popularity for carry trades among institutional investors.

Figure 1. Risk-return relationship for interest-rate-sorted currency portfolios

Return VS Beta

Return VS Downside beta

Note: The figures show average annualized portfolio excess returns (on the vertical axis) and the global market betas (on the horizontal axis) of 10 currency portfolios, sorted by interest rates (forward discounts), and the high-minus-low carry trade (CT) portfolio. The sample includes 42 countries over 1984 – 2013.