Hao Liang and Cara Vansteenkiste

Review of Finance, Volume 29, Issue 3, May 2025, Pages 851–886, https://doi.org/10.1093/rof/rfaf007

Corporate philanthropy often sparks debate about its impact on shareholder value, particularly in response to natural disasters. Is it a strategic move to enhance reputation, or does it reflect managerial agency problems? Using a global dataset of disaster relief donations from publicly listed firms, our study investigates this dichotomy.

We analyze stock market reactions to 1,162 disaster relief donation announcements made between 2006 and 2018. By focusing on cumulative abnormal returns (CARs) in a narrow window around these announcements, we capture investors’ perceptions of corporate philanthropy. On average, firms’ disaster relief donations lead to a 0.06% drop in CARs, equating to a $26.2 million loss in market value—significantly more than the average donation amount of $1.5 million. These findings suggest that donations often signal deeper agency concerns, particularly when managers use corporate resources for purposes misaligned with shareholder interests.

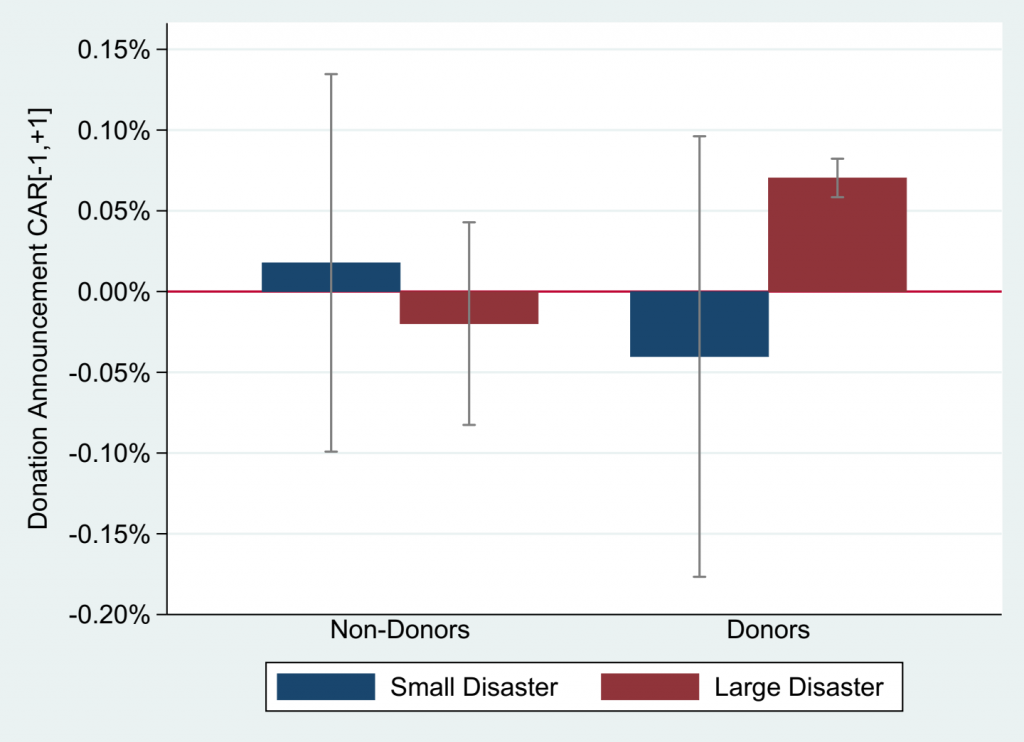

However, the strategic benefits of donations can offset these agency costs, especially in the context of highly salient disasters. We measure saliency using disaster severity (financial damages and casualties) and public attention (web search intensity). For example, a 1% increase in disaster saliency boosts the returns from donations by up to 0.17%, demonstrating the potential for philanthropy to build social capital when the public spotlight is strongest. Donations linked to highly visible disasters lead to positive CARs, whereas contributions to smaller, less notable events tend to amplify shareholder skepticism.

Our findings also reveal that the method of donation matters. In-kind donations, such as goods and services, result in higher returns compared to cash donations, which are more susceptible to agency concerns. Similarly, direct donations via corporate giving programs outperform contributions routed through corporate foundations, which are often linked to weaker governance structures and agency risks.

Using an instrumental variable approach, we establish a causal link between disaster timing, donation decisions, and firm value. Firms are more likely to donate when disasters occur early in their fiscal year, leveraging pre-allocated philanthropic budgets. Donations following salient disasters yield higher returns, emphasizing the role of public attention in enhancing the legitimacy of giving.

The strategic benefits of disaster relief donations extend beyond short-term stock performance. Donating firms experience increased customer awareness, higher domestic sales growth, and improved analyst recommendations. However, poorly governed firms see more pronounced negative returns, underscoring the persistent influence of agency problems in corporate philanthropy.

Our research contributes to the literature on corporate social responsibility (CSR) by disentangling the strategic and agency motives behind philanthropy. While agency issues dominate under normal circumstances, donations made during salient disasters can generate substantial reputation-building benefits, even leading to net positive returns in certain contexts. These insights help resolve the long-standing debate about the value of corporate giving, showing that strategic philanthropy can indeed align with shareholder interests under the right conditions.

Figure